With the recent volatility in the public markets and the macroeconomic backdrop changing rapidly, we thought we would quickly revisit the resulting implications to the M&A environment.

As widely documented, the last several years have represented a vibrant deal making setting, notwithstanding the impact of the Covid-19. Similar to real estate, it has been a seller’s market with a great deal of capital chasing quality assets. 2022 has seen a confluence of new factors, including rising interest rates, tight labor, supply chain challenges and the war in Ukraine, that have shifted confidence levels and have introduced new operational and financial challenges into the fray. That said, strategic consolidators and private equity alike continue to look for investment opportunities capable of supporting the strategic imperative to “win” over the long-term.

Here is sampling of market observations:

- Deal activity is coming off all-time highs – The expectation is for a slowing pace, but not an all-stop

- Public valuations as a double edge sword – The pullback in equities has not helped public buyers using their stock as currency, but it does present more attractive entry points

- Rising financing costs – With debt a key tool in acquisition financing, private equity returns may be challenged by larger interest expense and higher cost of capital

- Shift in focus – Buyer palates shifting back to opportunities not so highly correlated to a low inflation/zero-interest rate environment.

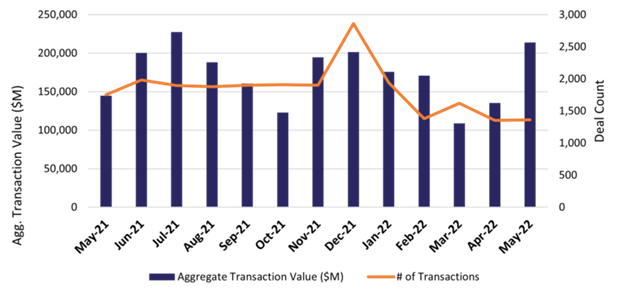

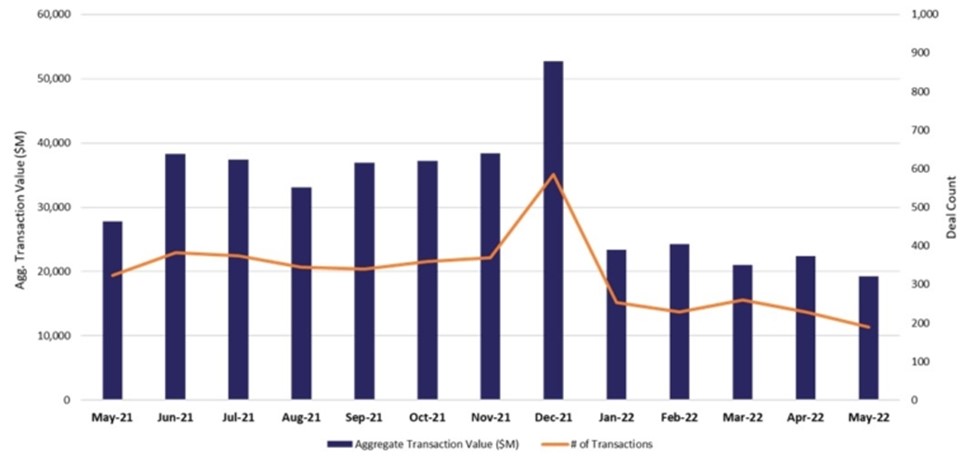

There is no doubt that the record setting pace of deals over the last few years will be dampened by the prevailing economic conditions. Nevertheless, resilient business models, with demonstrated pricing power and the ability to pass on cost increases, will still be in demand — a dynamic supported by the large quantities of dry powder still on the sidelines and needing a home (i.e. private equity alone is said to have ~$1 trillion+ of capital available to deploy!). The following are graphic illustrations of the aggregate deal value and volume of US deal making over the last year (through May 2022). The data below covers all industry sectors and deal sizes as well as includes private equity activity. The second graph drills down to middle market activity, as defined by transaction values between $10 million and $500 million.

Trend in US-based M&A Activity:

All Industries | All Trans. Sizes

Trend in US-based Middle Market M&A Activity:

All Industries | Transaction Sizes b/w $10 MM – $500 MM

Screen Source & Details:

Source: S&P Capital IQ

Transaction Type: Acquisition of 1) Whole Company (incl. Maj. Stake), 2) Min. Stakes, and 3) Asset or Branch

Private Equity Deals: Include

Target/Issuer Industries: All

Geography: USA

Date Range: From: 05/01/2021 To: 05/31/2022

Transaction Status: Announced, Completed

Aggregates: Transaction Value