As a firm that often works closely with entrepreneurs in the transition of their business, be it through a long range exit planning exercise or within the context of a sell-side M&A transaction, we are acutely aware of how complex and nuanced the sale process has become. Owner-operators, management teams, Boards, and more generally, the principal stakeholders need to wrestle with a host of issues. The laundry list includes establishing valuation expectations, defining strategic and cultural fit, securing livelihoods for their valued employees, determining what kind of process they want (auction or otherwise), formulating a buyer universe, pre-transaction due diligence, post LOI due diligence, reps and warranties within the P&S, and so on and so forth.

All of the above referenced aspects are important clearly (and sadly don’t represent every component), but the very simple issue of what you are actually selling, assets or stock, has a very meaningful impact to both the current and prospective owners.

Harnessing my powers of the obvious (yes, I do enjoy the Hotels.com Captain Obvious commercials), putting two companies together involves either the purchase of a target’s assets and liabilities (sold by the company) or the acquisition of stock of the seller (sold by the shareholders). Depending on the type of transaction (assuming a taxable transaction context), there are a number of considerations to be mindful of that will influence transaction complexity, liability, and taxes.

We understand that this is not a novel topic, but given there are both immediate and long term implications to the type of sale that is ultimately executed, we thought a quick refresh and primer on some of the major differences in transaction type might be valuable.

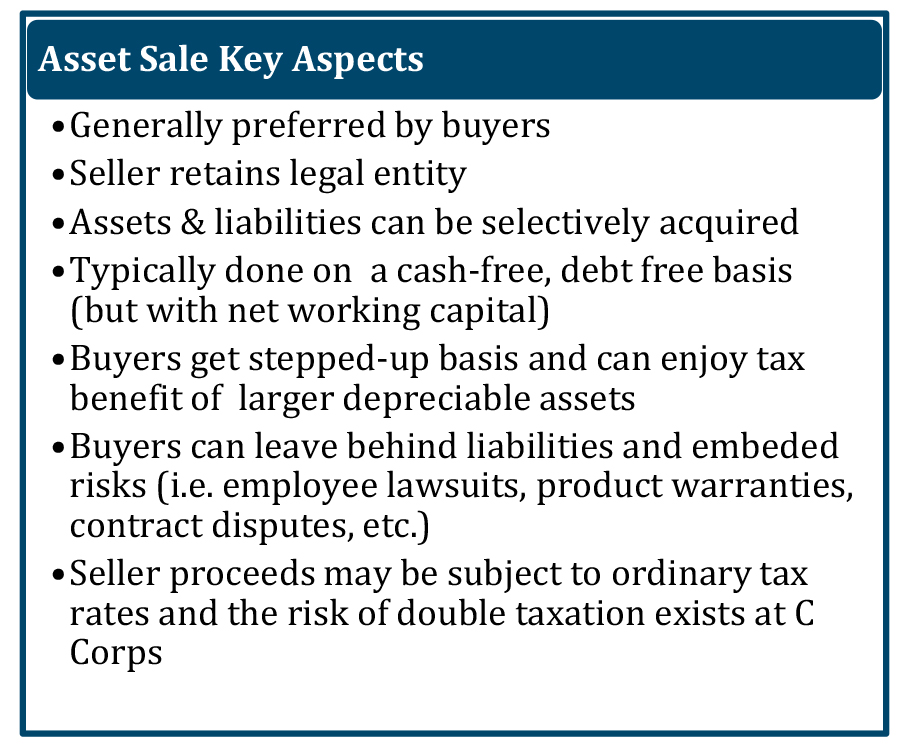

Asset Sale: In transactions involving the sale of assets, the buyer often specifically identifies which assets and liabilities they choose to acquire. An asset purchase agreement will be quite specific on detailing the acquired items, which can include your typical equipment, inventory, accounts receivable, and customer lists as well as intangibles such as IP and goodwill. An asset sale structure will allow the selling entity to divest an operating division while retaining control over the balance of the organization. If structured as a taxable transaction, a significant advantage and attraction for a buyer with regard to an asset acquisition is the step-up in basis of the acquired assets. This higher potential tax basis can minimize future taxable gains for the buyer while also providing tax deductible depreciation and amortization for qualifying assets. Since the buyer gains some tax benefits through this structure, the seller may have grounds for an increase in purchase price as they won’t experience the benefit from the stepped-up basis. [Please note: we are not tax experts and that anyone contemplating an M&A transaction should consult with their tax advisor]. Drawbacks to asset sales include potential complications transferring titles and valuable contracts that require 3rd party consent as well as more cumbersome valuation requirements.

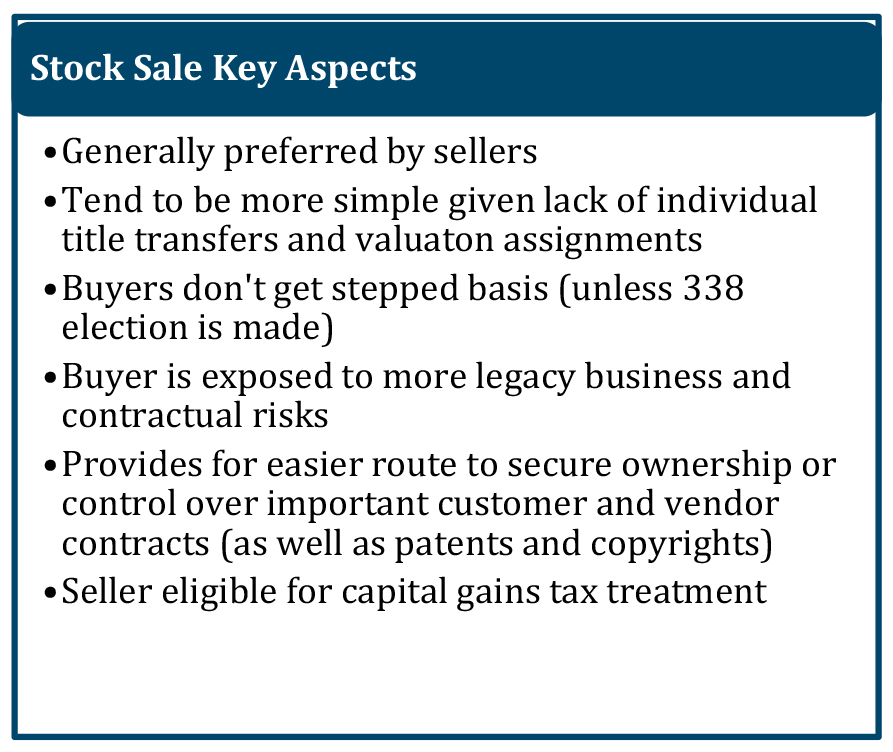

Stock Sale: Conversely, stock deals incorporate all assets and liabilities of the seller. In these instances, the buyer will receive a carry-over in basis as opposed to a stepped-up basis for tax purposes, and goodwill is not tax deductible. That said, there is an election that can be made, Internal Revenue Code Section 338, which would allow the stock sale to be treated as an asset sale for tax purposes. Stock sales are attractive for sellers, given they can “shed” all of the liabilities and the corresponding obligations at the time of the sale while benefitting from capital gains tax rates. While the conventional rule of thumb suggests buyers prefer asset sale, they may pursue a stock transaction to preserve or ensure better transfer of important lease and contractual arrangements. Undesirable assets or liabilities not wanted by the buyer can possibly be sold back to the seller or eliminated through payoff. Lastly, stock sales tend to have less moving parts given the lack of having to account for itemized title conveyance, etc.

So where should you come out on this subject? The answer is: It depends. While that may not be a satisfying conclusion, the reality is that this decision is influenced by a number of factors, inclusive, but not limited to, the nature and condition of the target business, the industry in which the target business operates, corporate structure (S Corp, C Corp, LLC, etc.) and so on down the line. There is no doubt that this is a large and complex issue. This article has only touched on the broad strokes and certainly does not reflect the full spectrum of considerations that both buyers and sellers need to evaluate. That is why it is so important to surround yourself with an experienced, cohesive team of advisors, inclusive of your investment banker or intermediary of choice, your CPA and your transaction attorney, that can collaborate on a holistic evaluation with the owner(s).

This article is not intended to provide legal or tax advice. Consultation with the appropriate professionals is recommended. Every transaction is unique and warrants individualized evaluation.

Peter Clarke

Chief Operating Officer

BaldwinClarke

Email: peterclarke@baldwinclarke.com

About the author:

Peter is the Chief Operating Officer of BaldwinClarke and a Senior Associate with BaldwinClarke’s investment banking practice. Peter spent over 10 years as a financial analyst in the private equity industry space before joining BaldwinClarke to further support the firm’s capabilities working with entrepreneurial clients.