Your grandparents may have purchased a permanent life policy, put it in a drawer and forgotten about it—and that might have been okay—but today’s life insurance policies are complex financial instruments and need to be monitored like any other asset in your portfolio. A permanent life insurance policy can be one of your most important financial assets and you want it to be there for your beneficiaries when it’s needed the most, or perhaps for your own retirement, if you purchased a cash accumulation contract. The best surprise is no surprise and a life insurance policy surprise is almost never good. A policy audit can tell you if your policy is in trouble or headed for it, and what corrective action may be possible.

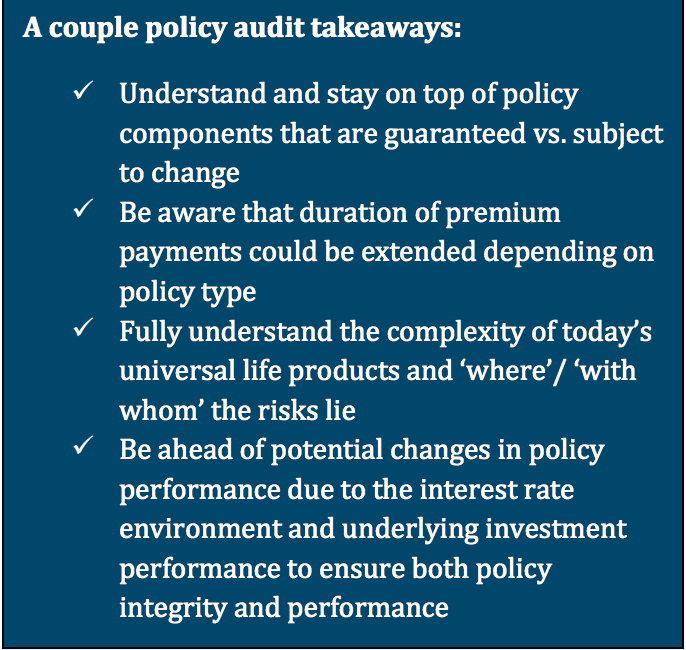

An audit is not just about the policy. What’s changed in your life is also important. What was the original goal of the policy? Is the goal still valid? If not, what is the new goal? Is the original beneficiary designation still appropriate? (Many lawsuits among family members are the result of the failure to monitor a policy’s beneficiary designation as family circumstances change.) Is the policy ownership structure still appropriate? Has the insured’s health improved thereby creating the opportunity to reduce premiums?

A policy’s long-term guarantees and projected performance are only as good as the financial strength of the insurer. A permanent life insurance policy is literally intended to be in-force for a lifetime: yours. An audit evaluates an insurer’s financial health as determined by various rating agencies and provides a review of the company’s financial strength as compared to statuary requirements and other insurer’s.

Now, back to your grandparent’s policy. Most likely it was a whole life (WL) contract priced to reflect conservative mortality and company investment return assumptions. Whole life policies have three guaranteed elements: death benefit, cash value accumulation and a level annual premium, all made possible, in part, by those underlying conservative assumptions. The guarantees increase the certainty that a whole life policy’s long-term promises of delivering the death benefit and cash value will be kept in almost any economic environment, assuming that the issuing company is prudently managed.

Whole life policies are issued by mutual insurance companies, which are owned by policyholders. For reasons too complex to be covered here, whole life policies pay dividends every year, however dividends are not guaranteed. (A White Paper on policy audits can be found at dcbcstg.wpengine.com/resources, which gets into those reasons and, perhaps more importantly, the details of the more complex vulnerabilities inherent in universal life policies discussed below.)

Dividends are a function of an insurer’s profitability, which is largely a function of investment returns. Many WL policies have been purchased with the expectation that policy dividends (current and accumulated) would one day pay premiums. Thanks to a prolonged low interest rate environment, dividends have been lower than illustrated at the time of purchase. Consequently, most of those policies will now require that premiums be paid out of pocket for more years than planned. An audit can show how the lower dividend payouts have affected anticipated policy performance. It is important to remember the guarantees offered by a WL policy: The death benefit is not at risk, nor is there a risk of increased premium rates.

The historic success of the bellwether WL contract notwithstanding, the insurance industry has developed new permanent products designed to provide a greater degree of premium payment flexibility, more transparency and generally lower premium requirements than WL. The first such product was what we now call traditional universal life (UL). In exchange for the above benefits, these policies lacked death benefit and premium guarantees, effectively transferring some of the mortality and investment risk from the insurers to the policy owners. The major risks with these contracts are loss of coverage and/or greatly increased future premium requirements. Many universal policies issued in the 80’s and 90’s have suffered those consequences. (You may wonder how this could have happened. The White Paper noted above has your answers.)

There are newer, far more complex UL designs: Secondary death benefit guarantee UL, variable life UL and indexed UL. Some introduce stock and bond market risk; others have additional performance characteristics that are subject to change by insurers after issue. Arguably, these policies especially call for regular review.

The low interest rates of the last several years have put pressure on insurance company finances. In response, some have increased the cost of insurance in existing UL policies, thereby increasing the premiums required to sustain the death benefit. A policy audit can determine if a policy’s coverage is at risk or if premium increases are likely. If caught early enough, corrective action can be taken.

In conclusion, the guarantees inherent in WL policies notwithstanding, the impact of reduced dividends should be understood. Universal life insurance, in all of its forms, has combined to make up approximately 75% of the market in the last five years. The risks inherent in UL can be managed if the policies are well funded and monitored. Of course, no matter the policy type, the current financial ratings of the issuing company also should be examined.

This writer’s personal view is that life insurance should be about transferring risk and providing financial security for the policy owner and beneficiaries, and not about taking on risk. That said, the insurance industry has created an array of products to meet the budgets and risk profiles of a wide range of consumers, and so it should be. But it’s on us as consumers to understand what we own and how it is working out, because what we bought is almost certainly performing differently than what was illustrated to us albeit in good faith and with full disclosure of the risk factors.

If you have any questions about your life insurance policy or would like to discuss a policy audit for your policy(ies), B&C is ready to assist. We have a team of insurance professionals with over 200 years of combined experience to help guide you through the audit process.

Charles (“Chuck”) Baldwin

Co-Founder and Principal

BaldwinClarke

Email: chuckbaldwin@baldwinclarke.com

About the author: Chuck is the co-founder and principal of BaldwinClarke and the President of BaldwinClarke. Chuck specializes working with entrepreneurs, individuals, and their families to deliver high touch planning solutions designed to create, preserve and transfer wealth.