“The housing market is hot. Is now the time to sell?”

As time marches on and life changes, there are many homeowners who are thinking that soon they may want to make a change in their home situation. Whether the house is just too big, too expensive, too much to keep up or just looking for life enhancing move, a change is likely to happen. The real estate market is still a sellers’ market and house prices are pretty much at their highest point ever.

So, therein lies the million-dollar question, is now the time to sell? This is indeed a tricky question, and the answer depends on many factors.

By undertaking a planning process with a long-term perspective, there is an opportunity to develop a life insurance strategy that addresses both your pre-retirement family continuity needs and your objectives for greater security and legacy in retirement.

"If I Die" Insurance

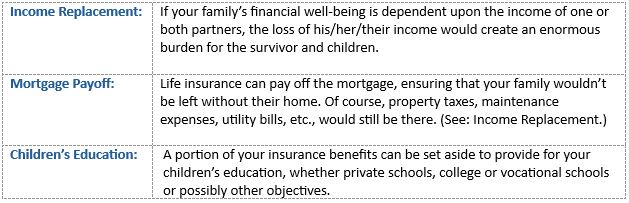

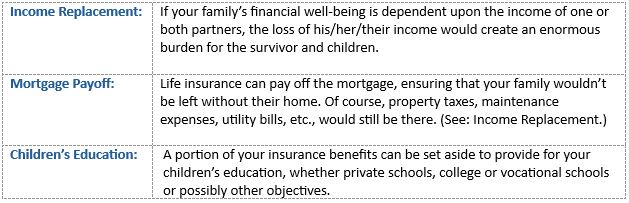

Prior to retirement, life insurance is needed to protect most families from three major financial risks. This is the “If I Die” protection.

In the following graph, these needs are represented by down sloping lines as they are assumed to diminish over time.

Donovan Equipment Company, Inc. and Donovan Spring Company, Inc. (together, the “Donovan Companies”), recognized leaders in the New England truck equipment industry, have been acquired by its accomplished and long-tenured executive management team. Originally founded in Lawrence, MA, the Donovan Companies have successfully grown over several generations of family ownership to be a leading truck up-fitting and equipment dealer serving commercial, municipal and individual customers in the region.

Founded in 1932, the Donovan Companies (www.donovancompany.com) now operate as a full line truck equipment and spring and suspension specialist out of its 73,000 square foot facility in Londonderry, NH. Started by D.G. Donovan and later lead by Donald Donovan, Donovan Equipment and Donovan Spring have continued to flourish under the stewardship of Darlene Donovan and guided by its fundamental principles - quality products and great service at a competitive price.

BaldwinClarke’s investment banking division, Baldwin & Clarke Corporate Finance, LLC (BCCF) served as the exclusive buy side adviser on this transaction, assisting the executive management team of the Donovan Companies on their acquisition of Donovan Equipment Company, Inc. and Donovan Spring Company, Inc. BCCF’s advisory services were provided to help facilitate the positive ownership transition to the Donovan Companies’ experienced leadership team who have successfully operated the businesses over many years and have taken great care to maintain the Donovan tradition of excellent service to its loyal customers.

Ahh…springtime! The birds are chirping, the grass is growing, and the world is in bloom. As with most of nature, there comes a time when the young must strike out on their own. The baby birds must leave the nest, the cubs must leave the den and, most importantly, for everyone’s sanity, your children will eventually need to move out of your house. The birds and bears have it easy - unlike ducks and humans, they do not have bills. 😊

Helping a child to successfully establish independence is never easy, and more challenging now. Rent prices are through the roof. College loans, car loans, medical insurance, and the dreaded credit card bills (thanks to Uber and Amazon) can make the financial aspect of leaving home seem very scary at the least.

However, all is not lost! There are some things that you can do to help your child get ready and prepare for life outside of your house.