We are pleased to announce BaldwinClarke’s article series: Selecting a Business Retirement Plan. The series will review retirement plan options for business owners. This article introduces readers to employer retirement benefits through a historical lens. Later articles will discuss key principles, compare options, and explore strategies.

A tight labor market demands careful attention to employee benefits. Employer-sponsored retirement plans are central to these packages. Retirement plans include pensions, 401(k)s, stock bonus plans, and numerous others. Plan designs vary, but all serve similar purposes. Retirement plans attract and retain top talent. A suitable plan also fulfills an entity’s financial goals.

Retirement preparation has always been important. Prolonged life expectancies and surging health care costs now render it a necessity. Data reveals the full extent of both trends. Mortality tables indicate that today’s 65-year-olds have a 50% chance of living to age 90. What’s more, there is nearly a 20% probability they will live to age 100.[1] Life expectancy leaps are partly attributable to health care advancements. Medical interventions repel fatal diseases and life-sustaining treatments keep our ill alive longer. These innovations, however, come at a cost. Experts estimate that an average couple may incur roughly $315,000 in retirement health care expenses.[2] Longer and more expensive retirement periods require substantial savings.

Retirement costs are widely recognized. As such, many workers embrace and even expect employer-sponsored retirement plans. Research ranks retirement plans as a top-three priority for prospective workers.[3] Moreover, three-quarters of employees say they would switch jobs for better financial benefits.[4] Businesses are responding to these concerns. In 2020, approximately two-thirds of private sector workers had access to employer-provided plans[5] and most took full advantage. Widespread participation leads to a more satisfied, engaged, and productive workforce.

Employer-sponsored plans provide clear staffing advantages. They also facilitate the organization’s financial objectives. Some plans favor older business owners, and other plans are more appropriate for early-stage entrepreneurs. Contribution preferences are also important, as some plans have higher contribution limits than others. Employer strategies are abundant.

Business characteristics also drive plan selection. The entity’s business model, staff composition, and liability preferences are key. Organizations with steady revenues may choose plans that require yearly contributions. Conversely, entities with fluctuating profits might opt for more flexible options. Businesses with high turnover might have stricter eligibility requirements than those with stable workforces. Finally, plan complexity varies greatly. Some organizations are better equipped to handle administrative burdens and liability concerns than others.

The choices might be vast, but the takeaway is simple. A plan exists for every business. It behooves businesses to choose wisely.

Plan Types

Any benefits discussion requires a basic understanding of plan types. Retirement plans fall into three broad categories: defined contribution plans, defined benefit plans, and nonqualified plans. Each type caters to particular goals and circumstances.

Most are familiar with defined contribution plans. These include standard 401(k) plans where the employee makes a defined contribution each pay cycle. Contributions can be pre-tax or post-tax. Some 401(k)s also offer employer matching contributions or year-end profit-sharing distributions. Employees make investment selections and market returns determine future account balances. Other defined contribution plans include Money-Purchase Plans, Target Benefit Plans, and Stock Bonus Plans.

Next up are defined benefit plans. As the name suggests, these plans guarantee fixed retirement benefits to employees. Sponsoring companies fund large reserve accounts to support this promise. Defined benefit plans, also known as pension plans, have fallen out of favor in recent decades. The next section explains why.

The third category is non-qualified plans. These plans are best characterized as simple and flexible. Non-qualified plans avoid federal eligibility, vesting, and contribution requirements. However, employers typically forfeit certain tax advantages in exchange. Non-qualified plans are sometimes referred to as “Top-Hat Plans”. They are useful tools lure top talent and retain key executives.

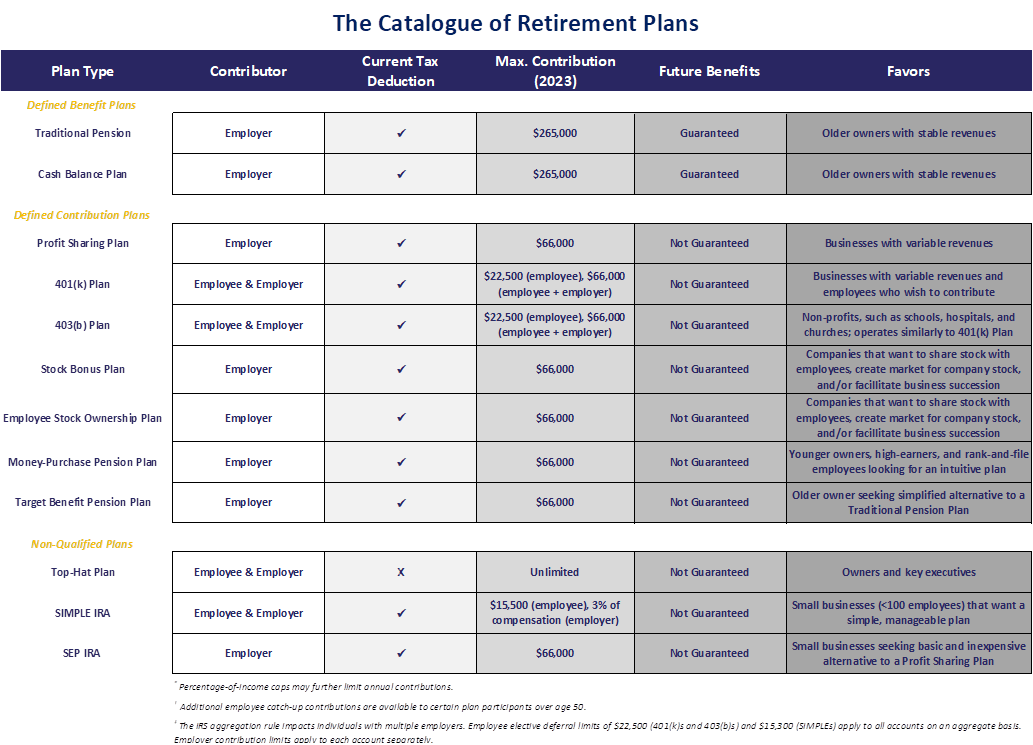

Plan options continue to expand with changing laws and preferences. The table below displays the breadth of retirement plan options. Plan details, advantages, and pitfalls will be discussed in future articles.

A Transformed Landscape

The retirement landscape has changed considerably in recent decades. While past generations received guaranteed pensions, today’s workers are largely responsible for funding their own retirement. This reflects decades of evolution in retirement plan design. Nowadays, traditional pension plans are only utilized in limited circumstances. [6]

Pensions extend guarantees in an uncertain world. The plan structure requires frequent, predetermined payments to retirees regardless of market performance. This places tremendous investment risk with the employer, as a pension reserve’s returns are neither predictable nor guaranteed. Decades of low interest rates and stock market volatility led many pensions to be underfunded.

Pension designs have inherent risks for employers, and societal changes exacerbated them. Longer lifespans extended the duration of each recipient’s pension benefits. Persistent inflation introduced an additional variable. Few plans offered cost of living adjustments, and many pensions failed to keep pace with rising costs in the 1960s and 1970s. Congress eventually sought to restore faith in the retirement system.

Today’s retirement landscape can be traced largely to the Employee Retirement Income Security Act (ERISA) of 1974. Although Congress had long flirted with retirement reform, the collapse of several prominent pension funds compelled meaningful action. Among other provisions, ERISA guaranteed pension payments for distressed plans and established minimum participation standards. The bill also charged the Department of Labor with overseeing plans and enforcing ERISA requirements. Pension plans became more transparent, accountable, and secure nearly overnight.

The 1970s gave birth to a less publicized but equally impactful innovation: the 401(k). Prior to ERISA, some companies allowed employees to defer income to a retirement account on a pre-tax basis. These accounts, called Cash or Deferred Arrangements (CODAs), attracted both employer intrigue and regulatory scrutiny. Growing curiosity finally forced Congress and the IRS to act. The Revenue Act of 1978 included a provision that formally permitted employees to defer income on a pre-tax basis. The IRS promptly codified the provision as Section 401(k) in the Internal Revenue Code. Suddenly, a cheaper, less binding, and more flexible option became available to employers.

This seemingly minor provision spurred a cascade of change. Business owners today enjoy an ever-expanding menu of retirement plan options. Employers can choose between pensions, conventional 401(k)s, and hybrids between the two. Other alternatives, such as Stock Bonus Plans and Employee Stock Option Plans (ESOPs), allow employees to become owners in the sponsoring business. Streamlined retirement plans, such as SIMPLE IRAs and SEP IRAs, are available to entities pursuing simplicity. Finally, a number of non-qualified plans avoid burdensome regulations and benefit key executives. See the above table for a comprehensive list of retirement plan options and features.

Plan Selection

Retirement plans serve both employees and owners. For employees, these plans are vehicles that help provide a comfortable future. For owners, employer-sponsored plans meet staffing goals, business objectives, and personal ambitions. Unfortunately, plan selection can be challenging.

Our business planning experience demonstrates that no two entities are alike. This is not surprising given the sheer volume of companies nationwide. Over five million new businesses are started in the United States each year. Behind each of these businesses lies a unique passion, vision, and management philosophy. Plan selection requires a comprehensive review of the business’ circumstances and priorities. Personalized guidance supports specific goals.

While businesses differ, one common theme prevails. Business owners crave more time – a resource as finite as it is valuable. Everyday tasks consume a significant portion of any owner’s week. Administrative obligations leave little time for strategic planning. As a result, many entities have ill-fitting retirement plans or no plan at all.

Professional guidance is invaluable. An experienced team can identify the appropriate plan for each organization. This leaves more time for owners to do what they do best: lead, create, and grow.

Bryce Schuler, CFP®

Financial Advisor

Baldwin & Clarke Advisory Services, LLC

[1] “Guide to Retirement”, J.P. Morgan, 2023.

[2] How to Plan for Rising Health Care Costs, Fidelity, April 2023.

[3] Retirement Plans Still Vital in Talent War to Retain Employees, Plan Advisor, November 2022.

[4] Workers Value a Good 401(k) So Highly, They’re Willing to Quit Their Jobs Over It, Money.com, December 2021.

[5] 67 Percent of Private Industry Workers Had Access to Retirement Plans in 2020, Bureau of Labor Statistics, March 2021.

[6] Pension plans remain advantageous to businesses with older owners and very stable cash flows. Pension strategies will be discussed in future articles.