I’ve recently read an interesting and frequently hilarious book by Richard Thaler: “MISBEHAVING: The Making of Behavioral Economics.” In this 2016 book he describes his efforts, and that of others, to challenge the entrenched belief that traditional economic theory is a reliable and accurate tool to explain human economic and market behavior. From his work with psychologists and other economists, he developed the now accepted field of behavioral economics. This article shares a few key concepts from his book and the related mental exercises are fun and reveal a bit about ourselves and the markets.

Thaler, an economist and the Charles R. Walgreen Distinguished Professor of Behavioral Economics at the University of Chicago Booth School of Business, was awarded the Nobel Memorial Prize in Economic Sciences for his contributions to behavioral economics in 2017. Incidentally, he is also a partner in Fuller and Thaler, a California-based investment management company.

Thaler uses the name “Econs” for the hypothetical beings assumed to behave as economic theory predicts. Not surprisingly, he calls the rest of us who “misbehave,” relative to economic theory expectations, “Humans.”

Thaler: “The core premise of economic theory is that people choose by optimizing. Of all the goods and services a family could buy, the family chooses the best one it can afford. Furthermore, the beliefs upon which Econs make choices are assumed to be unbiased.” (Remember this last point when we get to the confirmation bias discussion below.)

A bit later he writes, “This premise of constrained optimization, that is, choosing the best from a limited budget, is combined with the other major workhorse of economic theory, that of equilibrium. In competitive markets prices are free to move up and down, those prices fluctuate in such a way that supply equals demand. To simplify somewhat, we can say that Optimization + Equilibrium = Economics.”

This unified theory has led to economic models deemed to predict the behavior of fictional beings, Thaler’s Econs. In Thaler’s view, these models have led to many bad predictions with serious consequences, and have given economists considerable influence over public policy, a position of power not accorded to other social sciences.

Thaler and others believed that human behavior influenced markets and the economy to a degree unexplained by theoretical optimization and equilibrium. They worked to identify real life contradictory evidence to chip away at the establishment’s view. They conducted “…successful searches for disconfirming evidence – economic anomalies. As suggested by Thomas Kuhn, an economic anomaly is a result inconsistent with the present economics paradigm.”

During their quest to introduce empirical evidence of the many ways actual human behavior differed from what established economic theory predicted, Thaler and other “behaviorists” were thwarted by the establishment’s “confirmation bias.” The mere idea that human behavior held significant sway over the operation of the economy and markets was heresy to the establishment.

Here is an exercise related to confirmation bias that Thaler conducted with his students. Try it yourself.

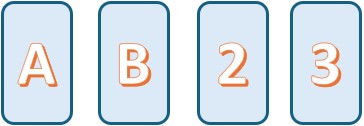

You are presented with the four cards shown below. Your task is to turn over as few cards as possible to verify if the following statement is true: Every card with a vowel on one side has an even number on the other side.

In what order did you turn the cards over?

The typical ranking of the cards in terms of most often turned over by Thaler’s students, is A, 2, 3, B. A is an obvious first choice because if it doesn’t have an even number on the reverse side, it proves that the statement is false. The second most selected choice is 2, but even if it does have a vowel on the other side, it doesn’t prove or refute the statement. To refute the statement, the far less frequent choice (3) must be turned over. But B, by far the least common choice, must also be turned over as a vowel may well be on the other side. (Note Thaler’s comment: “The problem as stated here, did not specify that numbers are always on one side and letters on the other side—although that implicit assumption is consistently made by solvers.”)

So, what’s the point? Thaler says, “Two lessons emerge from this problem. First, people have a natural tendency to search for confirming rather than disconfirming evidence, as shown by the relative popularity of the 2 over the 3. This tendency is called confirmation bias. Second, the confirmation bias can be accentuated when unwarranted assumptions make some kinds of disconfirming evidence seem unlikely, as illustrated by the unpopularity of turning over the B.”

Remember too that an underlying premise of economic theory is: “…the beliefs upon which Econs make choices are assumed to be unbiased.”

Think of this in the context of opinions we hold dear. We easily find support for our beliefs but might often dismiss or ignore possible counter points based on assumptions we believe to be reasonable. We are humans, after all.

Thaler then relates the struggle to challenge another stalwart of traditional economics that evolved in the 1960s: The Efficient Market Hypothesis (“EMH”). EMH holds that you can’t beat the market and that prices are “right”. The notion is that markets behave rationally. A fellow economist of Thaler’s at the Rochester Business School in the late 70’s wrote: “I believe there is no other proposition in economics that has more solid empirical evidence supporting it than the Efficient Market Hypothesis.”

By means of several research projects, including his own, Thaler demonstrated periods of time where value stocks and small stocks have outperformed the markets, refuting EMH’s claim that you can’t beat the market. Recently, growth stocks have outperformed the market. (Arguably, today’s Magnificent 7 are the market. Perhaps a case of irrational exuberance, which EMH says can’t exist.)

Other research provides considerable evidence that stock prices do revert to the mean, something that EMH says is impossible. He refers to the dramatic world-wide drop in stock prices for no apparent reason in September and October 1987. Forces, such as “overreaction,” were in play, nothing “rational” about it. If the price is “right,” why is there so much price volatility? Why such heavy daily trading if stocks are priced correctly? Clearly traders are expecting prices to change. Bubbles are driven by behavior, not rational market forces. The list goes on but does not dissuade EMH adherents who simply assume these aberrations away even if we see daily evidence to the contrary.

EMH tells us market prices are rational and you can’t beat the market. Behaviorists tell us investor sentiments and behavior strongly influence prices. What does this mean for investment managers and you when selecting stocks?

Thaler sees John Maynard Keynes as a true forerunner of behavioral finance. Keynes, a noted economist, is most remembered for his book, The General Theory and Employment, Interest and Money. He was also a professional investor, successfully managing his college’s endowment fund. Keynes thought markets prices were more reliable at the start of the century, when managers, with full knowledge of the company, owned most of the shares. When stock ownership became widely dispersed, Keynes became skeptical of market values. (Interestingly, Thaler’s investment management firm pays particular attention to insider trading activity in its approach to stock selection. A fact not mentioned in the book.)

By the mid 1930’s Keynes opined: “Day-to-day fluctuations in the profits of existing investments, which are obviously of an ephemeral and non-significant character, tend to have an altogether excessive, and even absurd, influence on the market.” Nothing’s changed, has it?

EMH expects investment managers to serve as the “smart money” that keeps the market efficient. Keynes, like Thaler, had little confidence that professional managers could fulfill that role, specifically noting their willingness to participate in waves of “irrational exuberance”—a modern term.

Thaler tells us that Keynes thought professional managers were essentially playing an intricate guessing game when picking stocks, much like a popular competition in the London financial scene in the 1930s. Thaler used an adaptation of that game with readers of The Financial Times.

Play along: Guess a number from 0 to 100 with the goal of making your guess as close as possible to two thirds of the average guess of all those participating in the contest.

Thaler helps you think through the puzzle: “Suppose there are three players who guessed 20, 30, and 40 respectively. The average guess would be 30, two thirds of which is 20, so the person who guessed 20 would win.” Make a guess before continuing.

Here are three levels of thinking about the problem.

- Level one: Lots of people picking a random number will choose something around 50. I’ll assume the average will be 50. So, my guess is two thirds of that, or 33.

- Level two: A second level thinker says most people will be level one thinkers, so I will guess 22, two thirds of 33.

- Level Three: A level three thinker will guess that most players will get to level two and guess two thirds of 22 or 15.

Of course, this regression can go on and on. In the Financial Times version, the winning average guess was 13. Many participants were proficient in math and answered 0, the “Nash Equilibrium.” (Read the book!)

Okay, what does this have to do with picking stocks? Here is a condensed version of Thaler’s discussion of how Keynes’s game analogy is still an apt description of what money managers try to do.

Value managers buy “cheap” stocks. (Low P/E ratios?) Growth managers try to buy stocks that will grow rapidly. (High P/E ratios?) All within Goldilocks bounds: Not so cheap that they will shrink, and not too expensive. They are both buying stocks that they hope will grow in value,“…or in other words, stocks that they think other investors will later decide should be worth more. And these other investors in turn, are making their own bets on others’ future valuations.” Essentially level three thinking on what decisions others will make on average.

As Thaler concludes: “Buying a stock that the market does not fully appreciate today is fine, as long as the rest of the market comes around to your point of view sooner rather than later.”

A stock’s price is supposedly the present value of future performance. Guessing game aside, we know that managers carefully evaluate stocks to include in their portfolios, but will their prices go up? Yes, if multiples rise, probably not if they fall. Otherwise, it depends on what investors choose to value. (See above.) Overvalued stocks, (P/E multiples predicting unrealistic future earnings) will fall in value. Significantly undervalued stocks (P/E multiples with prices far too low relative to actual earnings) will increase in value. Reversion to the mean is real.

My conclusion? Investment managers with documented disciplines for buying and selling “good companies” with proven results, over a full market cycle, will serve you well over the long term.

References: Thaler, R. H. (2015). Misbehaving: The making of behavioral economics. W.W. Norton & Company.

#BehavioralEconomics #MarketPsychology #InvestmentStrategy #StockMarketAnalysis #PortfolioManagementTips