By undertaking a planning process with a long-term perspective, there is an opportunity to develop a life insurance strategy that addresses both your pre-retirement family continuity needs and your objectives for greater security and legacy in retirement.

“If I Die” Insurance

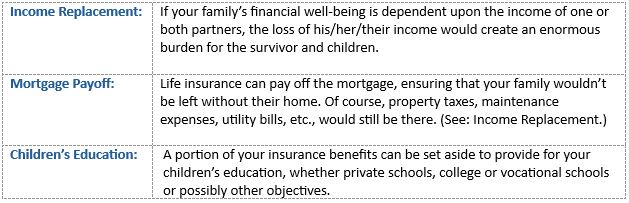

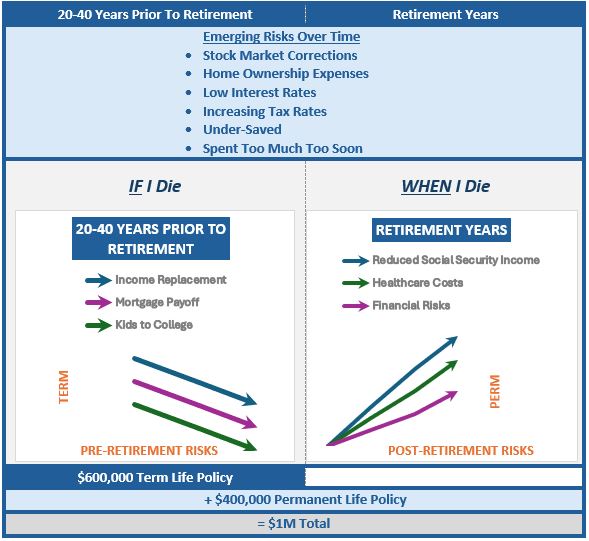

Prior to retirement, life insurance is needed to protect most families from three major financial risks. This is the “If I Die” protection.

In the following graph, these needs are represented by down sloping lines as they are assumed to diminish over time.

The closer you get to retirement, the fewer years of income you need to replace in the event of a premature death. With planning, you may have accumulated assets through savings, investments, 401(k) plans, etc., to provide retirement income.

By the time you retire, your mortgage may have been paid off, or significantly reduced, and your children’s tuition payments could be behind you.

So, all three of these major financial concerns may have disappeared by the time you retire. If these issues are of concern to you, you can purchase a 20- or 30- year term insurance policy that covers you until you retire.

Keep in mind that the loss of either partner would create a financial hardship even if one is not currently working. Term insurance should be a consideration for both partners.

A qualified financial or insurance advisor can help you determine how much insurance you would need to cover these “If I Die” contingencies. The analysis would look at current and expected future income and expenses, current assets and savings/investment plans, current insurance and your family’s objectives.

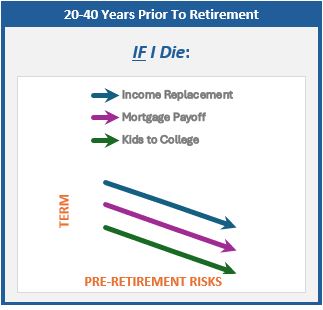

Many may think there is no place for life insurance in their post-retirement years. But is that really the case?

“When I Die” Insurance

Retirement is now a long-term consideration for most of us. According to the Social Security Administration’s 2021 Period Life Table (2024 Trustees Report), a man’s life expectancy at age 65 is 16.95 years and a woman’s is 19.75 years. For couples, the probability of at least one living past 90 is 54.9% based on the 2010CM Table (adjusted). But no matter how many years we may have left, we will be in the “When I Die” stage of our lives, like it or not.

As the upward sloping lines depict in the above graphic, there are many factors, or contingencies if you prefer, that create an increase in financial risk during retirement.

Your retirement income will likely come from Social Security, a 401(k) plan and other accumulated investment assets – perhaps rental property – or an inheritance. Here are some questions to consider as you and your partner plan today for your future retirement. These questions will also be top of mind when you do retire.

- If one of you dies, the survivor will be eligible to receive the greater of 50% of the deceased’s Social Security benefit or keep his or her own Social Security benefit, if it is higher. Either way, there is a significant income loss. How will that affect the survivor’s financial wellbeing?

- How confident are you that Social Security will even be available to you?

- What if you under saved or, the corollary, overspent in your pre-retirement years?

- If you spend down your assets during retirement to meet living expenses or emergency expenses such as medical bills, nursing home care, major home repairs, etc., how will that effect your income in future years?

- Will either or both of you outlive your income?

- What if there is a significant stock market correction?

- What if interest rates are low, and reduce the income on your fixed income assets?

- Do you expect income tax rates to be higher or lower in the future?

- Will inflation increase your expenses before and during your retirement years?

The reality is that some of these issues will be a factor for almost everyone in retirement at some time and in some way. Permanent insurance on the life of each partner can help.

- First, the permanent insurance policy can be designed to provide supplemental retirement income through cash and dividend values.

- If some of the contingencies listed above become a reality, the death benefit can mitigate the financial and emotional burden of their impact on a surviving partner.

- With proper planning, it may be possible to maintain the coverage through retirement without any out-of-pocket premium payments.

- The death benefit from the surviving partner’s policy will provide a legacy for your children and/or grandchildren, perhaps allowing you the freedom to more comfortably spend down assets for your own enjoyment during retirement.

Conclusion

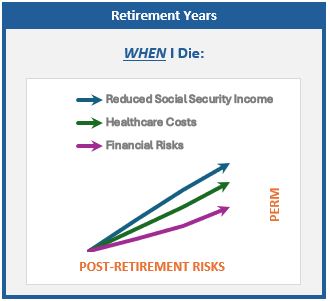

A properly designed insurance portfolio for a family should be combination of term insurance for “If I Die” and permanent insurance for “When I Die” as illustrated below.

The graphic illustrates a blend of 60% term insurance and 40% permanent insurance. The best allocation for you might be different. That’s where planning comes into play. But note that the policies are both issued at inception, with the term expiring at retirement.

The attractive feature of term insurance for very young families is the low outlay. But by their late 20’s or early thirties, families should begin the hard work of investing in their retirement. This is a good time to consider adding permanent insurance to the mix, if they haven’t already. Why? As they build an investment portfolio, for retirement, they can allocate some of the dollars that would have gone to fixed income investments into cash value life insurance instead, meeting two objectives with one dollar – a weak play on the “killing two birds with one stone” idiom.

If you would like to learn more about the concept of cash value life insurance as a compliment to a fixed income portfolio, see “Life Insurance as an Asset Class.”

Acknowledgements: Graph concepts courtesy of Corebridge Financial

#LifeInsurance #FinancialProtection #RetirementPlanning #FinancialSecurity #TermInsurance