A federal deficit occurs when spending exceeds revenue. Federal spending supports Social Security, Medicare, military defense, and countless other programs. Federal revenues largely come from taxes.

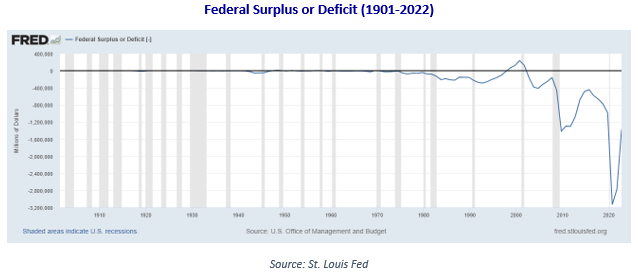

The federal deficit is tracked annually. The chart below shows key deficit trends. The U.S. maintained a relatively balanced budget throughout most of the twentieth century. Change began in the 1980s when sweeping tax cuts met increased spending. The deficit grew modestly before shrinking again in the 1990s thanks to rapid economic growth. This trend sharply reversed in 2001 following additional policy changes.

The United States has carried a budget deficit ever since. The 2020 deficit remains the largest ever at $3.1 trillion. Corresponding debt ceiling increases have sustained deficit growth.

#finterms #federalspending #deficit #federaldeficit