Interest rates are the cost borrowers pay for debt. This concept is well-understood, as nearly every loan carries some amount of interest. Less understood are the dynamics between interest rates, markets, and the Federal Reserve.

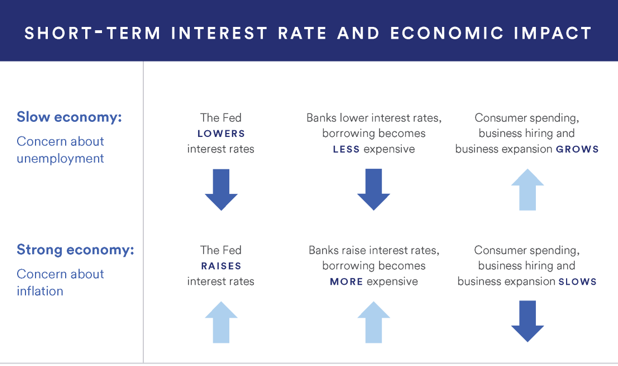

Business cycles have peaks and troughs. The Federal Reserve seeks to moderate these swings by controlling the money supply. This is accomplished by adjusting the discount rate, or the rate the Federal Reserve charges member banks for loans. Higher interest rates slow lending activity and limit currency circulation. Conversely, lower interest rates encourage new loans and promote economic growth. Borrowing costs eventually “trickle-down” to household mortgages, consumer car loans, and every other debt category imaginable.

Interest rates also impact stocks, bonds, and the broader economy. Individuals often have larger appetites for stocks and goods when interest rates are low. Businesses may keep pace by hiring more staff or raising prices. The opposite can be true in a high interest rate environment. Yields increase with interest rates, making bonds and savings accounts relatively more attractive. Individuals may also curb discretionary spending when interest rates rise. Diminished demand can ease inflation.

These are merely historical patterns. Rate adjustments foretell neither prosperity nor downturn. Many forces impact economic growth and market activity. It is therefore difficult to predict rate outcomes with any precision.

#interestrates #investments #markets #FED