The Markets

The year-to-date (YTD) combined bond and equity market sell-off for the first six months is a rarity. Historically, negative returns in both stocks and bonds, over six-month periods, has occurred only 4% of the time (observation period: 1926-2022).

That six-month episode is also characterized by larger losses compared to the historical averages: Stocks are down 20% vs. the historical average of 10.3%, and bonds are down 5.8% vs 1.6%. (Source: GS Investment Strategy Group, Datastream.)

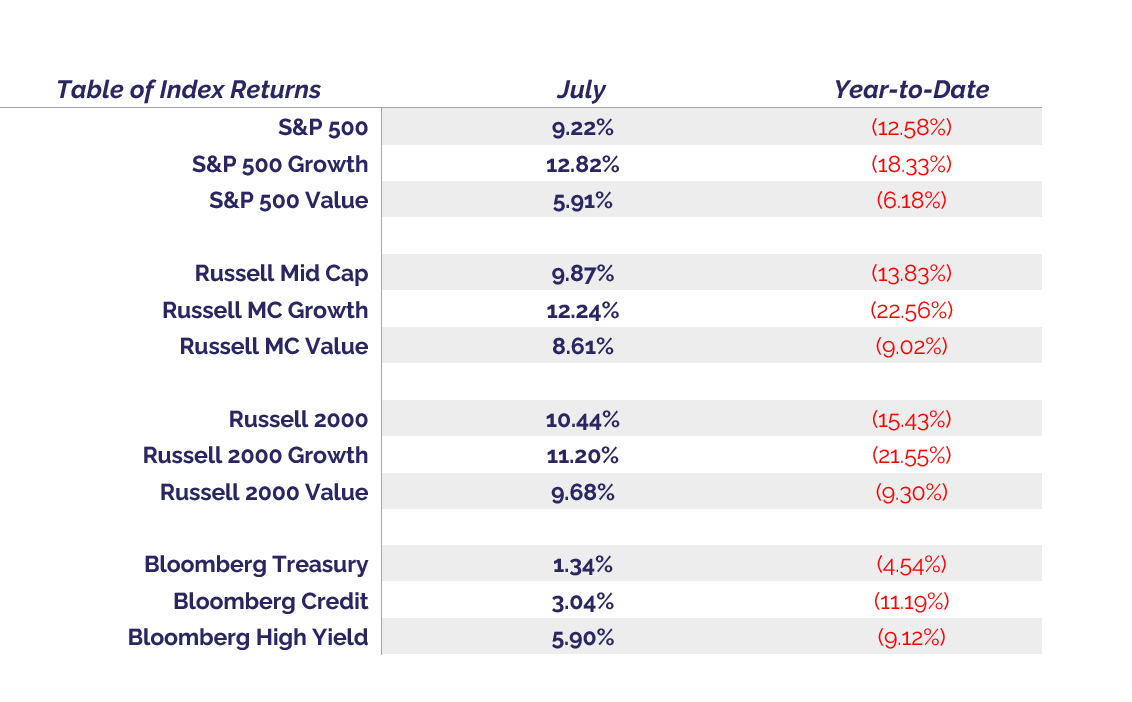

Thankfully, July returns were positive, and the markets have moved off their lows. The following recap is as of the end of July.

Interestingly, growth outperformed in all cap sizes in July, while value led the way by a wide margin YTD. Growth stocks hit their highs in November of 2021. Investors began running from high-earnings rate companies in the face of macroeconomic headwinds and the likelihood of rising interest rates. Companies with the highest earnings growth rates, particularly the so-called hyper-growth software companies, were hit the hardest. By the end of June, the NASDAQ composite was down 31% from its November highs, and the Russell 2000 Growth index fell 37%.

Equity markets valuations are forward looking. In theory, they are discounted values of future expectations. When interest rates rise, future earnings are discounted at higher rates. Values of companies with the highest earnings growth suffer the most, explaining the dramatic multiple contractions of high-flying tech stocks.

Why the July turnaround? Earnings. During the week ending July 15th, companies that make up 15% of the S&P 500’s market cap reported their earnings; 72% of them had exceeded their earnings estimates. In week three, 170 of the S&P 500, and 12 of the Dow 30 companies reported their earnings. All told, as of July 22nd, 50% of the market cap of the S&P 500 has reported. Week four had high tech giants, Apple, Amazon, Google, Microsoft and Meta all hit the tape. While results were mixed, there were nuggets of optimism. Amazon and Apple reported revenue gains which sent their stocks higher. Microsoft’s revenue was down, but it anticipates double digit growth. Meta was the biggest disappointment.

As expected, the Fed raised the Fed Funds rate by .75%. It seems that action was already baked into the markets. Perhaps more importantly, Chairman Powell signaled that future rate increases would be “data dependent” and moved away from the previously announced rate increases for the rest of 2022. The market reacted very favorably with a big rally, led by big tech.

Recession

Are we, or aren’t we? It sure feels like we are. The initial 2nd quarter GDP number is -.9%. Two consecutive negative GDP quarters is a common rule-of-thumb indicator that we are in a recession. But recessions usually come when unemployment is high. We are at full employment (3.6%). We added 375k new jobs in June. There are more job openings than applicants. But some companies have announced layoffs or suspended hiring to combat rising costs. Consumer spending was up in June (except for autos and light trucks). Yet, durable goods sales were up 1.9% in June when estimates were -5%. Walmart’s earnings were down because customers are buying low margin items like food, rather than higher margin items like clothing and electronics.

There are mixed signals, but Fed Chairman Powell is confident that we are not in a recession because of the labor numbers. Keep an eye on the unemployment rate. If it increases, the Fed will likely have another large rate hike which could trigger a market pull-back. Rising interest rates will hurt consumers as credit card debt is near an all-time high.

Inflation, as measured by the Consumer Price Index (CPI) has dropped to 8.9%, but it will persist for some time (the four horsemen of the inflation apocalypse are riding tall—Energy, Wages, Supply Chain and Housing). The Personal Consumption Expenditures (PCE) index is up 6.8% year-over-year (highest since January 1982) and the Core (ex. food and energy) version of PCE is up 1% month-to-month to 4.8%. The latter is the Fed’s preferred measure. There is ample evidence that the economy is slowing. If the Fed raises rates too much or too quickly, it will push us into a recession.

Increasing rates does slow the economy down, but is that the right remedy to curb inflation? Some say no. Economist Brian Wesbury said, “The Fed is a using a drill to hammer a nail.” He, and others, argue that the money supply (M2) is the primary cause of inflation (too much money chasing too few goods). Fiscal policy could further exacerbate the M2 problem. The Fed could help reduce the M2 by removing assets from its balance sheet by something more than the trickle we have today. Chairman Powell has said that the Fed will reach its maximum planned balance sheet tapering rate in September. We may be heading for a worst-case stagflation scenario: persistent slow growth with inflation.

Another sometimes indicator of a future recession is an inverted yield curve which we have today. The yield on two-year treasuries is higher than the yield on 10-year treasuries.

What we see, hear, and read leads us to think that a recession is not only possible, but also likely in the next 12 to 24 months.

There is only one group—The National Bureau of Economic Research—that can date a recession, and it is not tied to any rules-of-thumb.

Concluding Thought and Tidbits

Long term investors should continue to hold a diversified mix of equities and fixed income with an allocation (perhaps 10 to 15%) to reasonably liquid alternative asset classes.

Individual investor allocation to equities is as low now as it was during the pandemic. Reportedly, there are five trillion dollars sitting on the sidelines, just waiting to be invested. When investor psychology reverses the next time, we may be in for a nice ride. Let time be our guide.

Charles H. Baldwin, MBA, CLU, ChFC

President and Chief Compliance Officer

Baldwin & Clarke Advisory Services, LLC

Email: chuckb@bcasi.net