Business Valuations

Valuation Applications

Formal credentialed appraisals:

- Estate and gift planning

- Stock Transfers

- Shareholder buyouts

- Buy-sell planning

- Incentive equity stock option plans

Strategic analysis for owners and management:

- Sale and business combinations

- Strategic and management planning

- Succession and shareholder planning

- Capital Planning

experience

Our firm has been providing professional valuation services for over 25 years.

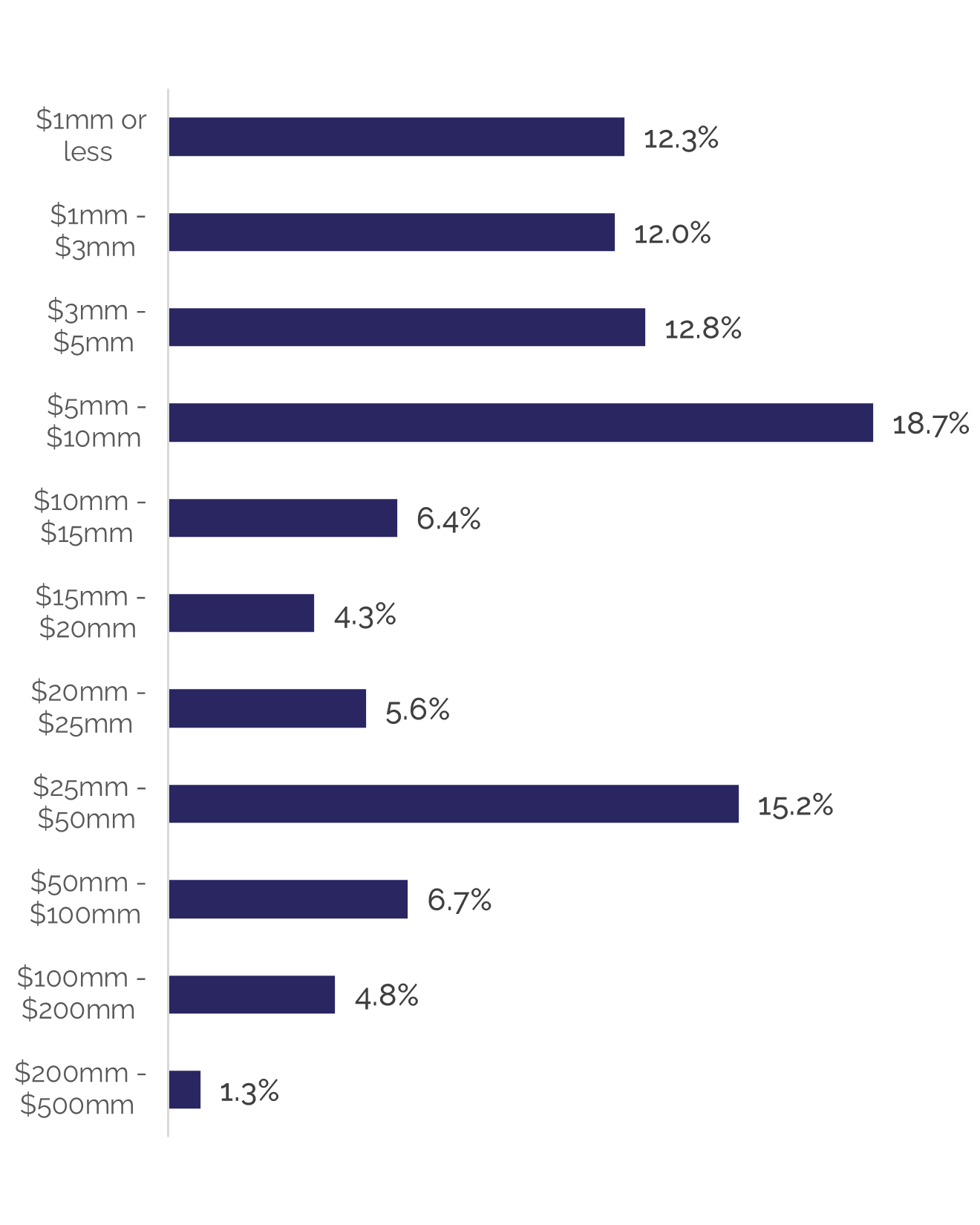

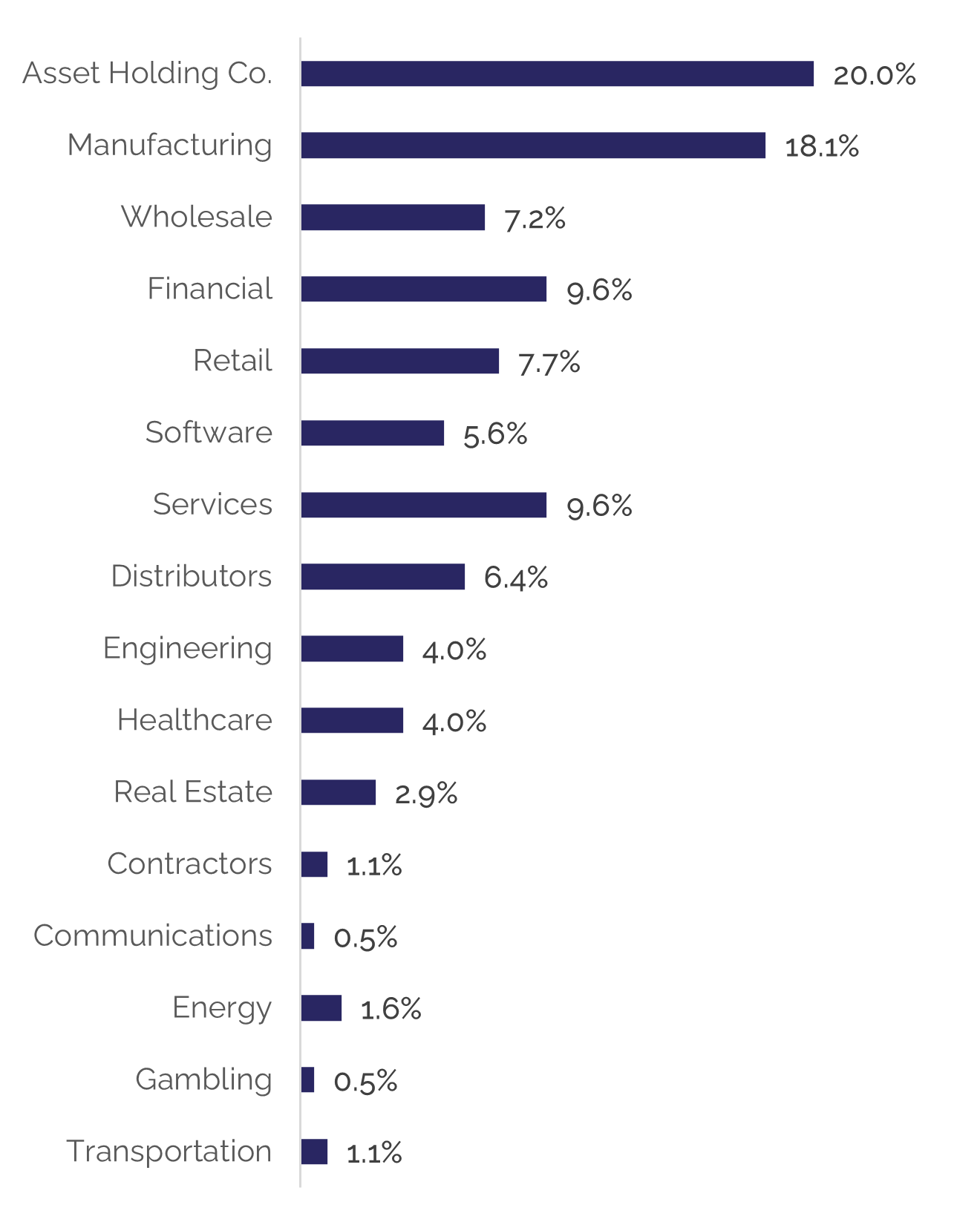

Our professional staff has experience evaluating entities with revenues ranging from less than $1 million to above $200 million and has worked across a wide range of industries.

BaldwinClarke professional credentials include:

- Accredited Senior Appraiser (ASA)

- Certified Valuation Analyst (CVA)

- Certified Merger and Acquisition Advisor (CM&AA)

Focus

We specialize in valuing privately-held lower middle market companies.

Through our deep experience and effort to fully understand our clients’ goals and objectives, we work diligently to establish a strong understanding of value and the drivers behind it.

Client Solutions:

- Understand business progress

- Support corporate governance

- Assist with tax planning

- Facilitate transitional initiatives

- Evaluate exit alternatives

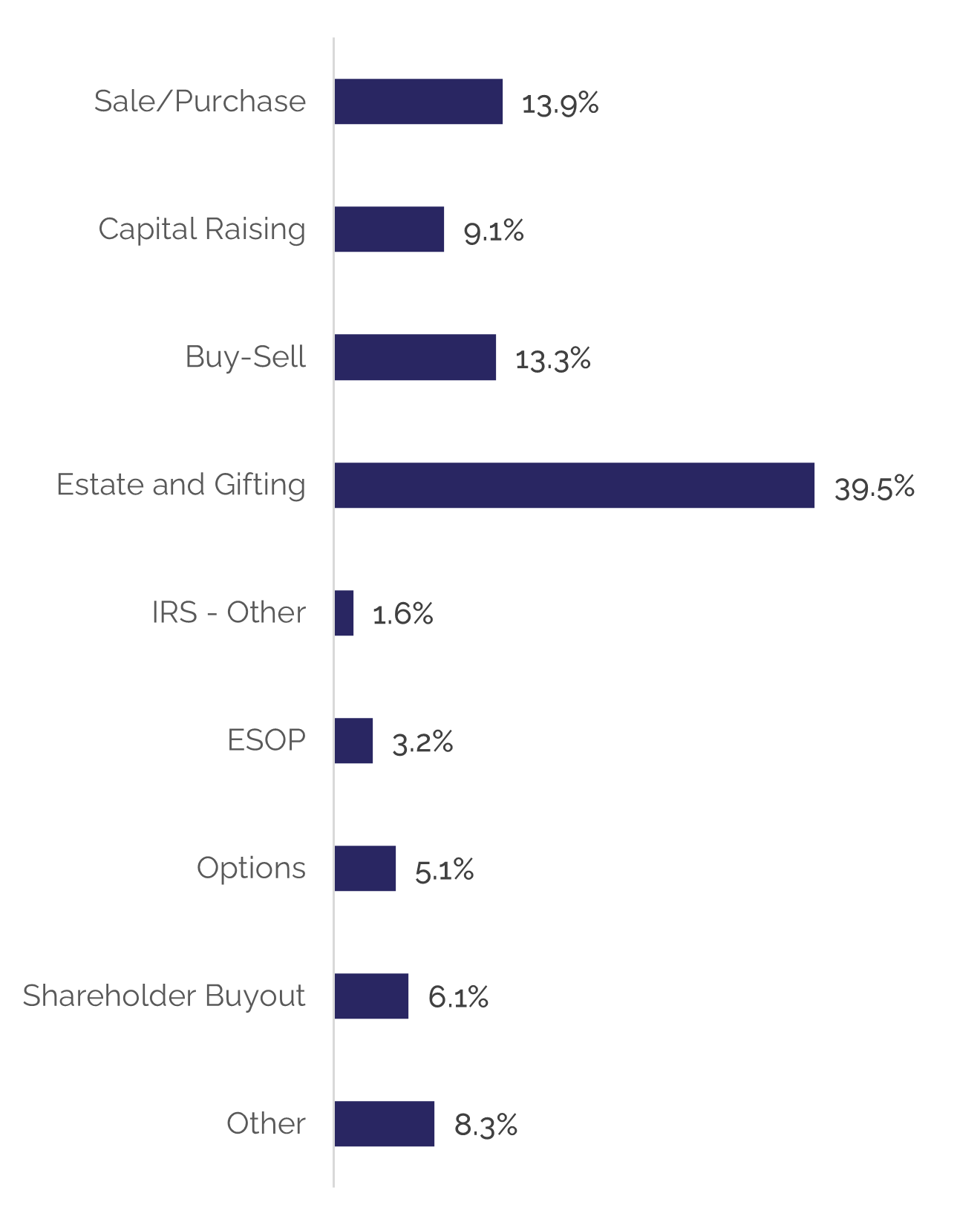

Experience by Valuation Application

Valuation Purpose and % of Engagements

Engagement by Revenue/NAV

Revenue (NAV) Size and % of Engagements

Engagement Experience by Industry

Industry Classification and % of Engagements