Business retirement plans are tax-deferred savings vehicles for owners and their staff.

We introduced readers to the complex world of employer-sponsored plans in Article 1 of this series.

This installment offers a decision-making framework for business owners.

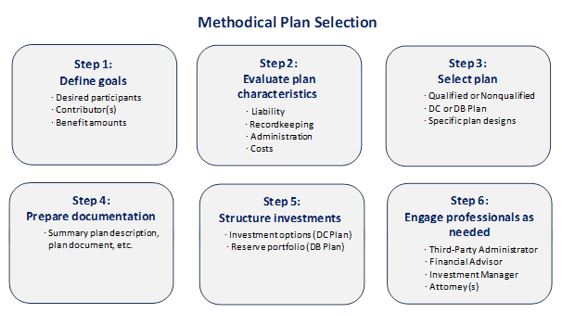

Many retirement plans are available to business owners. The number of options can be overwhelming. Stringent regulations and recordkeeping requirements introduce an added layer of complexity. Fortunately, a systematic approach makes the selection process more manageable.

Plan adoption involves several interrelated steps. Goal setting is perhaps the most important action. This requires the company to decide who will participate, which party(ies) will contribute, and how much it would like to provide. By defining clear objectives, the owner can form a list of plan options. Next, businesses should review the responsibilities and costs associated with each option. Companies then choose a plan that best meets their criteria. Once a selection is made, owners prepare documentation, select investments, and implement the plan.

This article provides a decision-making framework for business owners. In reality, companies typically leverage outside professionals throughout the process. Investment professionals, third-party administrators, and attorneys all offer important services in this area. Regardless, an informed business owner is also a judicious one. A knowledgeable plan sponsor can mitigate costs and avoid headaches.

BaldwinClarke offers over fifty years of business planning experience. We proudly serve as a consultant and advisor for plans of various sizes. Our methodical process prioritizes education and objectivity. This fosters trust and allows business owners to focus on what they do best.

Nonqualified Plans vs. Qualified Plans

As explained earlier in this series, business objectives determine plan suitability. There is no uniform solution for business owners. Plan selection instead resembles a jigsaw puzzle. Certain retirement plans fit particular companies.

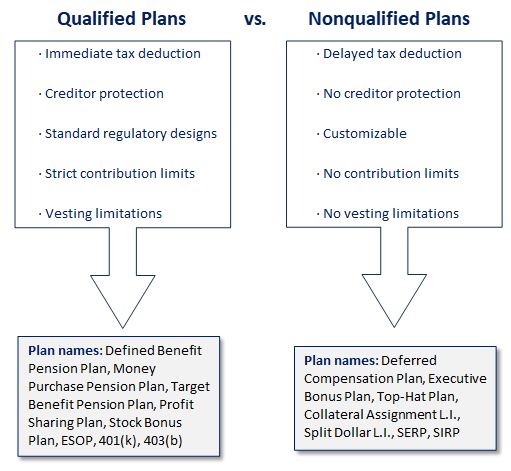

This is best exemplified by comparing nonqualified and qualified plans. Both have their pros and cons. The right answer mainly depends upon whom the plan is designed to benefit. Contribution limits, tax rules, and administrative preferences also play a role.

Nonqualified plans have more flexibility but fewer tax benefits. [1] Nonqualified plans – also called Deferred Compensation Plans, SERPs, and Top-Hat Plans – can be tailored to serve unique purposes. These plans usually benefit owners and key executives, and actual benefits might be contingent upon certain performance benchmarks or a minimum period of service. Employers are free to exclude certain employees, craft incentive features, and implement long-term vesting schedules. Companies can also contribute unlimited amounts on behalf of participants.

Nonqualified plans are dictated by customized contracts rather than federal regulations. This flexibility comes with two caveats. The IRS’ concept of constructive receipt prohibits employers from deducting plan contributions until an employee actually receives the money. Nonqualified plan benefits can be withheld for years or even decades, delaying employer write-offs until some distant date in the future. Furthermore, benefits may disappear if the company goes bankrupt.

Qualified plans, on the other hand, offer immediate tax deductibility and bankruptcy protection. These plans are designed to benefit both executives and rank-and-file employees. The Federal Government has taken great measures to make sure of this. Qualified plan requirements concern participation, contributions, and vesting.

The full list of qualified plan rules falls beyond the scope of this article. However, businesses should be aware of several guidelines. Qualified plans must include all employees over age 21 after one year of service. [2] Eligibility standards are further restricted by employee coverage ratios, minimum participation tests, and non-discrimination standards. Contribution limits are equally significant and vary widely among different plan designs (See Article 1: “Business Retirement Plans of the Modern Age”). Vesting limitations range from three to seven years depending on plan-type and staff composition.

Each category suits a different purpose. Nonqualified plans benefit specific staff members, while qualified plans include most full-time employees. Plan characteristics also matter. Nonqualified plans are fully customizable. Conversely, qualified plans tolerate strict rules in exchange for tax privileges and creditor protection. Once owners select a plan category, they choose a plan type. Future articles explore these plan designs in detail.

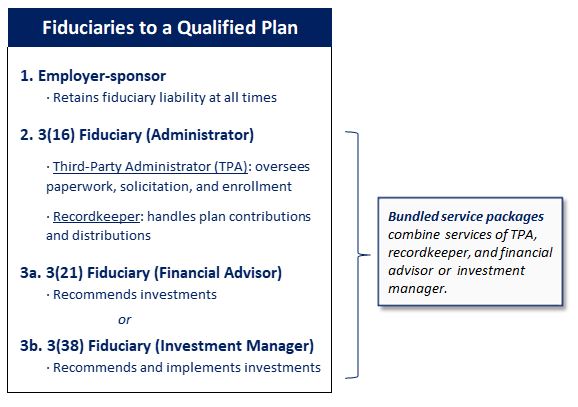

Plan management can be intimidating. Employer-sponsored retirement plans usually have reporting requirements, educational obligations, investment mandates, and countless other responsibilities. Owners rarely have the capacity or expertise to perform these tasks. Fortunately, certain professionals specialize in operating business retirement plans.

Operating a Qualified Plan

Qualified plan requirements are particularly onerous. Convoluted rules deter employers and stiff penalties instill fear. As a result, many companies avoid retirement plans altogether. Businesses can overcome these hurdles with outside help.

Fiduciary liability is central to qualified plans. First introduced in 1940, the fiduciary standard addressed industry-wide issues related to self-dealing. The core duty of any fiduciary is to serve the best interests of plan participants and beneficiaries. The fiduciary standard is a high bar that requires careful attention to fees, incentives, and education. It also places tremendous responsibility upon employers offering qualified retirement plans.

Employers generally retain fiduciary liability at all times. They can, however, reduce liability exposure by outsourcing certain responsibilities. The tax code identifies three fiduciary responsibilities in a qualified plan: the 3(16) fiduciary (plan administrator or recordkeeper), the 3(21) fiduciary (financial advisor), and the 3(38) fiduciary (investment manager). Professionals specialize in each area.

The 3(16) fiduciary incorporates two sets of responsibilities. The first category is purely administrative and includes plan solicitation, documentation, and enrollment. Many companies hire a Third-Party Administrator (TPA) to complete these tedious and time-consuming obligations. The TPA might also file and sign Form 5500 each year for the IRS. The second category involves plan funds. Someone must be responsible for processing plan contributions and allocating the additions accordingly. Professional recordkeepers fulfill this need.

Some businesses receive administrative and recordkeeping services in a bundled package. Other businesses hire separate specialists to perform each function. Regardless, owners should beware of one cautionary point. Some recordkeepers work exclusively with a particular fund company, limiting investment options to a preset menu. Businesses should instead pursue an open architecture recordkeeper that offers investment options across multiple fund companies, asset classes, and investment strategies.

Both 3(21) and 3(38) fiduciaries specialize in plan investments. Each monitors regulatory changes and recommends investment options. However, a key distinction exists between the two. 3(21) fiduciaries, or financial advisors, act as consultants. They present investment suggestions, and the employer decides whether to implement them. Under this arrangement, the financial advisor and the employer share fiduciary liability for any investment decisions. Registered Investment Advisors (RIAs), such as BaldwinClarke, commonly fill this role.

3(38) fiduciaries, or investment managers, have discretionary authority. This arrangement offloads research and decision-making responsibilities to a third party. The investment manager is free to select investments and make changes as necessary. A 3(38) fiduciary assumes much of the liability associated with qualified plan investments. While these services entail additional costs, some businesses gladly accept this tradeoff for more peace of mind. Banks and trust companies often provide 3(38) fiduciary services. RIAs can then provide additional oversight and participant education as needed.

Qualified plans provide significant tax benefits. These plans are also fraught with administrative obstacles and regulatory landmines. Outside professionals can provide welcome guidance.

Operating a Nonqualified Plan

Nonqualified plans are much simpler to operate. There are fewer regulatory hurdles and administrative requirements. Still, outside professionals play a key role in structuring these arrangements. Important planning activities typically occur at the outset.

Nonqualified plans typically have a funding source. Benefits might be paid from company assets, future earnings, or even life insurance. A competent planner can determine the ideal approach and recommend corresponding documentation.

Attorneys

At their core, business retirement plans are agreements between employers and staff members. These agreements require documentation. Sophisticated laws and regulations further complicate the matter. Legal questions, claims, and disputes are common. Lawyers offer important resources to all types of employer-sponsored plans.

Employers may consult an attorney during plan adoption. ERISA attorneys specialize in qualified plan arrangements. They monitor legislative developments, review compliance implications, and address any liability concerns. Third-Party Administrators typically have in-house counsel for these matters. Nonqualified plan arrangements also benefit from proactive guidance. Lawyers often draft nonqualified plan agreements outlining terms and benefits. This ensures that all parties are on the same page.

Additional legal services may be necessary during the plan’s lifetime. Lawyers assist companies undergoing mergers, acquisitions, and/or workforce reductions. They also provide meaningful advice to companies facing employee disputes and regulatory inquiries.

A strong foundational footing reduces future difficulties. This is a theme throughout all business planning activities. Retirement plans and advisory teams should be selected with particular care. Problems are easier to prevent than cure.

Personalized Guidance

The number of retirement plans might seem overwhelming, but humans make difficult decisions every day. Consider the typical restaurant experience.

Restaurants often have extensive food and beverage menus. Patrons do not simply order at random. Rather, they compare options and make careful choices. This is a deductive process that considers restrictions and preferences. A customer may write off certain items due to allergies or other predispositions. Likewise, that night’s special might be too extravagant or costly. The final order balances several competing factors. Retirement plan selection is no different.

More options often lead to heightened anxiety. Psychologists dub this phenomenon the paradox of choice. In a restaurant, the customer manages this anxiety by consulting a server or sommelier. These experts provide personalized insight and recommendations based on the customer’s palate. This describes BaldwinClarke’s role in the retirement plan selection process.

BaldwinClarke guides business owners through each stage of the plan selection process. Our systematic approach records, processes, and analyzes an owner’s goals. Plan recommendations emerge from personalized discussions. Business clients continue to lean on BaldwinClarke for ongoing guidance, years or decades after a plan launches.

Bryce Schuler, CFP®

Financial Advisor

Baldwin & Clarke Advisory Services, LLC

[1] SIMPLE IRAs, SIMPLE 401(k)s, and SEP IRAs are also considered nonqualified plans. These plans serve distinct situations and will be covered separately.

[2] Employers may extend the service requirement to two years if contributions vest immediately.