Looking back at key factors and forces that shaped market results for 2023

and ahead with economic, market and portfolio thoughts for 2024.

Looking Back

Looking back, 2023 was a year of catch phrases: “Transitory Inflation,” “Higher for Longer,” “Supply Chain,” “The Magnificent Seven,” “A Recession is Coming,” “Soft Landing,” “Goldilocks Scenario,” “Stagflation,” “What about the Fed?” “Santa Claus Rally.” As the year unfolded, U.S. equity markets fluctuated up and down in the first half of the year then had three consecutive down months ending in October, with the S&P 500 hitting the low for the year on October 17th. Then, against that noise and backdrop, came a remarkable holiday gift: a widespread market rally.

The “What about the Fed?” question, as answered during the year by investors and the Federal Reserve itself, drove the movements in equity and bond returns. Investors reacted to every expectation of what the Fed would do next with rate hikes, and to what it actually did. Fed rate hikes (“Higher for Longer”) and the prolonged inverted yield curve drove investors to money market funds and short-term treasuries. This retreat pushed stock prices lower as demand for risk assets fell. In October, the yield on 2-year treasuries hit a 17-year high of 5.12%. The 10-year followed suit with a 16-year high of 4.7%.

The movement to money market funds was record-breaking. Money flows into money market funds in the year following the October 2022 stock market lows, had a net increase of over $1.1 trillion, or 24.4%. That is the largest jump ever following a market low. (Sources: S&P, Bloomberg) J.P. Morgan estimates that $6 trillion is currently sitting in money market funds and CDs.

Inflation moderated. A strong third quarter GDP report of 5.2% (later reduced to 4.95%) lessened recession fears. Investor sentiment turned positive in anticipation of an end to rate hikes and the beginning of rate reductions in early 2024. The result: decreasing 10-year treasury yields and increasing stock prices. Following the Fed’s December 13th meeting, Fed Chairman Powell announced that future rate hikes were unlikely and rate reductions in 2024 were possible. The market quickly raised its expectation of four 25 basis point rate cuts to six. The “Santa Claus Rally” took hold. Small cap stocks led the way with an extraordinary one-day gain of 3.5%.

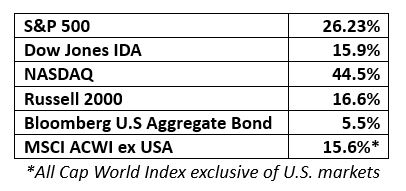

Here’s how the major markets finished the year from a performance perspective:

Size mattered in 2023. The mega cap “Magnificent Seven” continued to drive the return of the S&P 500 for most of the year. Morningstar reported that these seven stocks – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – accounted for 75% of the index return through June, and 52% through December 21st. Drugs developed to treat diabetes turned out to be effective for weight loss as well. Consequently, pharma stocks, such as Eli Lilly and Novo Nordisk, also did well in 2023. Energy and utilities were the only sectors with negative returns for the year.

Overall, the broad U.S. equity market (small, mid, and large cap combined) was up 25.80%. Growth stocks were up 37.95% and value stocks returned 10.89%. Core stocks gained 17.12%.

Small cap core stocks rebounded from very low valuations with a return of 20.54%. Small value posted a 14.36% return and small growth gained 25.5%. (Source: Morningstar. Data as of December 21, 2023).

Bonds recovered from their worst year ever (2022 – the first year that stocks and bonds moved down together since 1948), with a return of 5.5%, uncharacteristically they continued to move with stocks. Fortunately, it was a mutual upward swing in 2023. Generally, stocks and bonds move in opposite directions, with bonds serving as a risk modifier when equity markets fall.

Bottom line for 2023 year-end: Investors priced in six rate cuts for 2024 and expect a soft landing. Did they get it right? If not, we may see a very bumpy 2024.

One last observation for 2023: the unexpected year-end rally reinforced the difficulty of timing the market if you are a long-term investor. The successful ones diversify and stay invested.

Looking Ahead

Our buzz word for 2024 is “Normal.” We have come through the 2020 and 2021 Covid years and the resulting monetary and fiscal policies of 2022 and 2023. The Fed’s rate hikes were the fastest and highest in 40 years. With those artificial disruptions behind us, we anticipate a return to a more normal economic and capital market environment. We saw signs of this after the Fed put the brakes on rate hikes last year. Bond investor actions drove yields along the still inverted yield curve, rather than artificial Fed tinkering. That’s how the bond market is supposed to work.

We expect normal economic forces to be at work this year. Monetary policy is on pause, shortages and “Supply Chain” disruptions are behind us (for the most part), and inflation has moderated substantially. Normal forces should prevail, unless the Fed reinstates rate hikes or miss-times rate cuts – both events are possible thanks to persistent economic uncertainty. The continuation of excess government spending (more than $6.1 trillion and a $1.7 trillion deficit last year) could also derail normalization. Normal, we should add, doesn’t necessarily mean smooth.

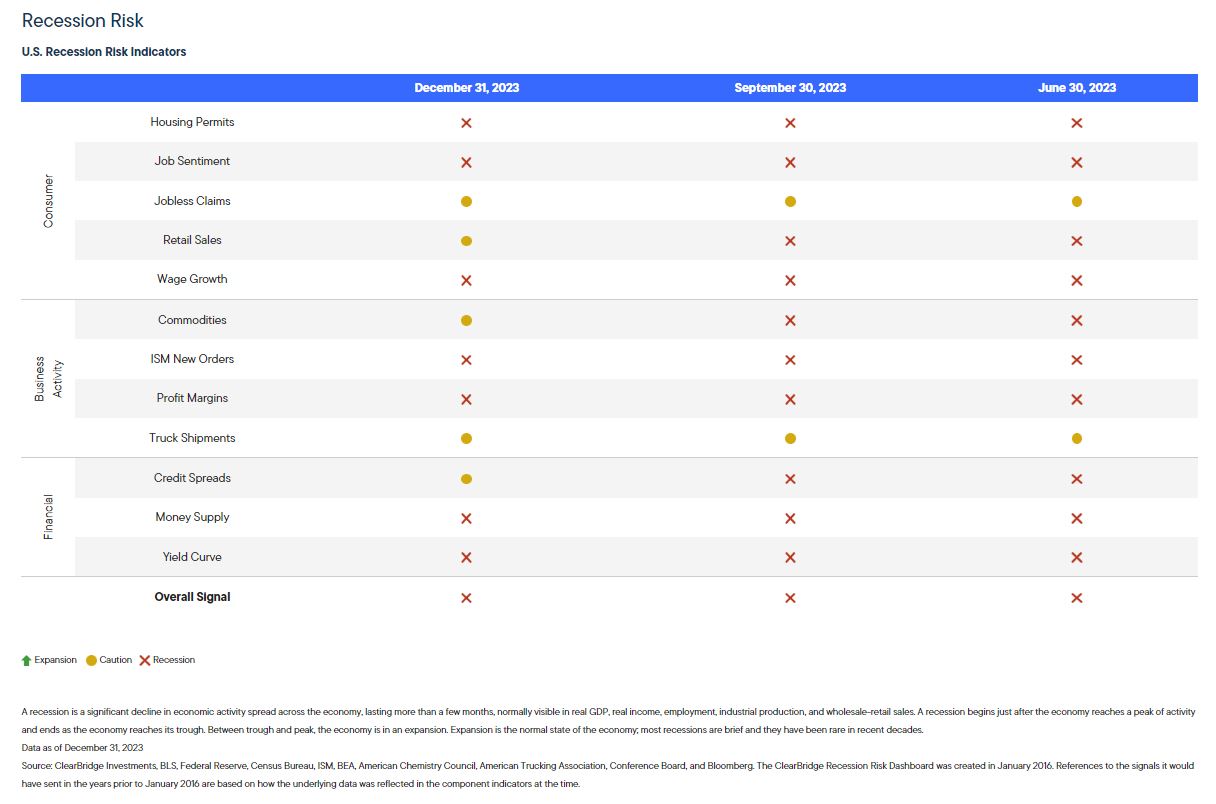

What about a recession? The consensus has moved to a “Soft Landing.” But it depends on who you ask: First Trust anticipates a mild recession. ClearBridge’s U.S. Recession Risk Indicators point to a recession (see chart below). Goldman Sachs has lowered its recession risk probability to 15%. Morningstar says no recession. With or without a recession, the U.S. economy will continue to slow down. Fourth quarter U.S. GDP growth estimates come in at or near 2.5%. Estimates for 2024 year-over-year GDP growth range from 1.6% to 2.1%.

Inflation, despite having increased in December, should continue its decline as the economy slows. It’s likely that the lag effect of the Fed’s rate hikes has yet to be fully felt. Year-end 2024 inflation estimates come in at 2.5%. The Fed Fund’s rate is expected be in the 3-3.5% range at year-end. This moderating trend is a relief, but it’s worth remembering that inflation is a thief. It corrodes both stock and bond returns. Still, unless the December up-tick was a warning sign, the “Stagflation” scenario may be off the table.

What about the markets? The year has begun on the downside, and we would not be surprised by a six to eight percent pull back. The unusually high year-end rally has already priced in much of the expected good news for 2024. Corporate earnings are expected to decrease, which will dampen returns. That said, we expect modest single digit equity returns for the year. Goldman has set its expected S&P 500 return for 2024 at 6% as of November 20, 2023.

A healthy sign for equities is the broadening of the market at year end, as noted earlier. In 2023, the cap weighted S&P 500 index outpaced the equal weighted index by 12.7%. That’s the largest gap since 1998, after which there was a reversion to the mean. The previous leaders declined, and the followers became the leaders. (Sources: FactSet and S&P.) As interest rates normalize, at least some the $6 trillion sitting on the sidelines should make its way to the equity markets and help returns.

More tactically, small-cap stocks, mid-cap stocks, energy stocks, and value stocks more generally are undervalued and may well be better performers in 2024 than overvalued growth stocks (Source: Morningstar). Stocks with histories of growing dividends have dominated after Fed tightening cycles. These companies may offer the opportunity to exceed broad market return expectations. (These are Morningstar’s estimates of under and over valuation.) (Market Outlook December 29, 2023.)

With respect to the Magnificent Seven, J.P. Morgan agrees that they may be overvalued, but suggests that the overvaluation may be justified by its growth of free cash flow versus the rest of the S&P 500 stocks. (EYE ON THE MARKET Outlook 2024, January 1, 2024.)

The bond market is poised for strong returns as interest rates moderate. More importantly, we expect a return to normal bond market volatility. Historically, when the MOVE Index (a measure of bond market volatility) is greater than 100%, the next 12-month returns are strong. The current index level is 114.62%.

We’ll close with this succinct summary paragraph from J.P. Morgan’s EYE ON THE MARKET Outlook 2024:

“The challenge for investors: the damage to public sector finances from mega deficits, markets that already price in a very soft landing and the concentrated contribution of mega cap stocks. In 2023, S&P 500 earnings were flat; they were up 33% for the seven mega cap stocks and down 5% across the rest of the S&P 500. All things considered, 2024 looks like a year of slowing GDP growth, single digit earnings growth and single digit returns on the median S&P 500 stock.”

Keep an eye out for our upcoming blog on long-term capital market expectations and how they are used to create optimal long-term risk/return portfolios.

Co-Founder & President

Baldwin & Clarke Advisory Services, LLC

#marketupdate #lookingahead #USeconomy #Fed #MaginficentSeven #Stagflation #recession