Drivers behind today’s seller’s market

It is no secret that the merger & acquisition (“M&A”) market has been vibrant and showing no signs of slowing down anytime soon. There are a plethora of statistics and charts that can be produced to demonstrate the health of the M&A market, but an exhaustive quantitative review of transaction activity will be for another day. That said, let’s at least set the table with a couple instructive reference points for context.

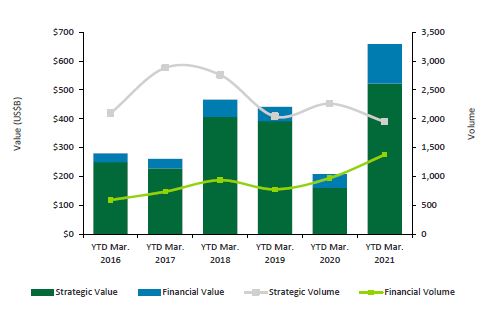

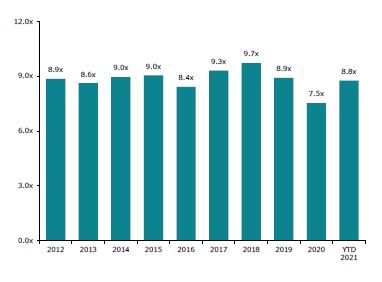

First, from a broader macro standpoint, the following data sets from a July 2021 Deloitte Dbriefs report clearly outline US transaction activity exhibiting resilience and strength – both from a volume and valuation standpoint (please keep in mind the trend lines below do not distinguish between deal size or industry).

U.S. M&A value and volume

Median U.S. enterprise value to EBITDA Multiples

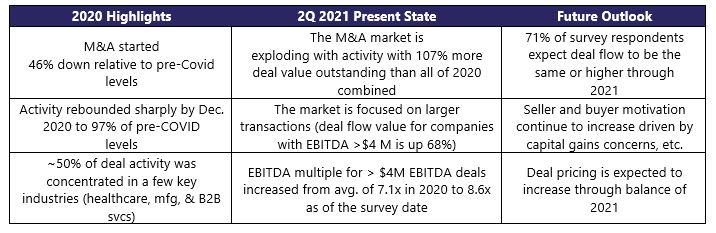

Drilling down a bit further into the middle market arena, we point to the M&A Access 2021 Q2 M&A Market Report (a joint effort from the Alliance of Merger & Acquisition Advisors and Dealware), which is an in-depth survey of key findings and analysis from over 2,300 current M&A deals reported from various deal intermediaries.

Key takeaways from this survey report include:

Conditions are always subject to change thanks to potential shifts in economic or political environments (say nothing of the recurrence of a global health crisis), but for now, times are good. Valuations proved surprisingly resilient throughout the Pandemic and volume has now returned to robust levels. There appears to be a strong appetite across buyer types to deploy capital and supplement organic growth, which has created a seller’s market. Let’s explore why!

Qualities underpinning today’s favorable M&A market

- CEO confidence on the rise – business leaders appear to be gaining confidence in their business footings, thereby promoting more of a “risk-on” owner mentality. Emerging out of the Pandemic, owner-operators are becoming less inwardly focused and starting to revisit or re-image opportunistic growth strategies.

- Supply & demand – companies that “sat on the sidelines” for much of 2020 are now entering the healthy M&A market. Companies that are considered A+ assets and have demonstrated operational resilience during these times are being heavily competed over.

- Dry powder – by many different accounts, there is an abundance of capital sitting on the sidelines with a natural pressure to be deployed. The SPAC boom from earlier this year, coupled with strong corporate balance sheets and bountiful private equity fund raising, has resulted in as much as $3 trillion of unallocated capital in the marketplace.

- Strong currencies – thanks to a robust equity market rebound from the market trough in April 2020, many buyers with public currencies have a much more valuable tool to provide acquisition consideration.

- Availability and cost of debt – the interest rate environment continues to be historically low, and banks are presently awash with liquidity, the combination of which is helping to make leverage an attractive financing component for transactions.

- Changes in taxes – the current Biden Plan (see our June blog post for more details) represents significant potential tax changes, specifically in the way of capital gains being treated at ordinary income rates for income >$1 M. As such, business owners are accelerating go-to-market decisions in attempts to get ahead of the potential upward movement in rates.

The healing and accelerating economy has certainly supported the strong U.S. M&A market. The collection of market forces outlined above continues to foster acquisitive growth while also providing compelling exit conditions for business owners to consider. Nevertheless, the conducive environment that currently exists needs to also be measured against the personal timetables, financial and emotional objectives, and business performance and preparedness. The decision to transition one’s business, most often the largest and most important asset of their net worth, is never a simple or siloed decision. But when the confluence of interconnected factors lines up to support such a decision, it is sure nice to have a tailwind at your back.

Peter Clarke

COO & Managing Director

BaldwinClarke