It seems logical to conclude our business retirement plan series with guaranteed pension plans. These plans are unique because benefits are guaranteed and there are no annual contribution limits. Both features accommodate significant tax-deferred retirement savings for the right companies.

There are many different types of retirement plans. Each serves a specific set of goals and circumstances. This month’s article focuses on pension plans – a rare but worthy option for select businesses.

Certain pension plans promise a guaranteed income stream in retirement. These plans are funded entirely by the employer. Annual contributions are mandatory and driven by return assumptions, life expectancies, and turnover expectations. Contribution formulas typically favor longtime owners approaching retirement. The reasoning for this is fairly simple: aging owners have longer tenures and shorter retirement deadlines.

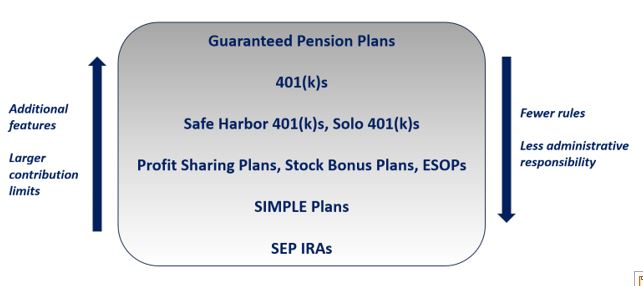

Previous articles tracked the evolution of retirement plans. Readers learned that there are now leaner, less expensive, and more flexible alternatives to guaranteed pension plans. Still, guaranteed pension plans can be attractive due to their unique contribution rules. Pension plans accommodate substantial annual contributions, allowing aging owners to reduce their tax bills and jumpstart retirement savings goals.

Guaranteed pension plans permit large annual contributions but have high costs and significant administrative responsibilities.

Choices and Tradeoffs

Financial planning is full of tradeoffs. Workers choose whether to spend for now or save for later. Investors make important decisions surrounding risk and returns. Businesses decide between flexible and rigid retirement plans.

There is generally a correlation between complexity and benefits among retirement plans. More complicated plans offer certain advantages for employers willing to assume additional responsibilities. As the saying goes, with great power comes great responsibility.

In the world of retirement plans, the adage might be modified to say with great benefits comes great rigidity. Pension plans allow certain owners to defer significant amounts on a pre-tax basis. This benefit comes with strict funding requirements, compliance obligations, and administrative burdens. For these reasons, guaranteed pension plans only suit highly stable businesses willing to fulfill these duties.

Applying the Concept

Consider a real-world business with two aging owners. Both owners want to save aggressively and retire imminently. Savings goals exceed the $76,500 annual contribution ceiling for 401(k)s.[1] The owners turn to a guaranteed pension plan for this reason. Annual additions could total hundreds of thousands of dollars depending on the plan terms and actuarial assumptions.

Several other factors support this selection. Namely, the business has stable revenues and a small, young workforce. Strong cash flow can support large annual additions. A small support staff minimizes participation among rank-and-file employees. Moreover, young workers require smaller contributions than older owners thanks to the time value of money – an important concept discussed in the next section.

This specific example illustrates a broader point. Guaranteed pension plans require distinct circumstances. These plans are costly, complicated, and rigid. Such obligations are tolerable when goals and benefits align. In this case, the owners can stash away significant assets for retirement. They also save thousands on taxes since all contributions are tax deductible.

A cost-savings analysis can be instructive. Pension costs typically depend upon the group size and benefit commitments. Savings come in the form of immediate tax reductions. The exact savings amount also correlates to the plan’s scale – larger annual contributions mean larger savings. Future tax rates are another consideration, as pension income is taxed as ordinary income in retirement. A competent advisor can conduct a personalized evaluation.

Time Value of Money

Pension benefits are linked to the time value of money. The concept holds that a dollar today is worth more than a dollar in the future. This is because today’s dollar can be invested for long-term growth. Markets tend to rise over long time periods, rewarding those who are patient and disciplined.

Pension reserves are invested to keep pace with inflation and fund future benefits. Senior employees typically retire sooner than young employees, leaving less time to grow their account balances to guaranteed levels. All else equal, older participants require larger annual contributions than younger participants to fund the same guaranteed retirement benefit.

The rulebook acknowledges this reality. As mentioned, there are no contribution limits for guaranteed pension plans. The company instead decides each participant’s retirement benefit at the outset.[2] An actuary then reviews the plan each year and determines the contribution necessary to support these benefits. Plan contributions can skew heavily toward older owners depending on the company’s goals, revenues, and staff demographics.

Pensions Defined

Pension is a broad and often misused term. For the purposes of this article, a pension plan is any retirement plan designed to produce a defined income stream in retirement.

Several plans fit this category. This article focuses on Defined Benefit Pension Plans and Cash Balance Plans. Both are considered true pension plans because benefits are guaranteed. Other pension plans – namely Money Purchase Pension Plans and Target Benefit Pension Plans – have greater flexibility and no guarantees. All differ from the classic “set it and forget it” 401(k) plan, where participants make salary deferrals, choose an investment portfolio, and spend down the total balance in retirement.

No contribution limits apply to guaranteed pension plans. This means older participants may be eligible for substantial annual additions.

Guaranteed Pension Plans

The Defined Benefit Plan is the archetypal pension plan. The employer promises workers a predetermined retirement income benefit based on their ages, salaries, and/or tenures. An actuary reviews the plan each year and determines the contributions necessary to fund these promises. Annual contributions enter a reserve account where the funds are invested for both stability and growth.

A Cash Balance Plan introduces a small tweak to this design. Employer contributions enter a hypothetical individual account for each participant. This allows workers to monitor their personal account progress. Participants may also receive these benefits as a lump sum instead of an income stream. Employer contributions are still mandatory and the company guarantees a minimum investment return.

Pension Alternatives

Guaranteed pension plans have unique features but significant burdens. Businesses often avoid them due to revenue fluctuations, administrative reluctance, or risk sensitivity. Fortunately, variations exist for employers seeking a similar design with greater flexibility. Two plan types occupy this middle-ground: Target Benefit Pension Plans and Money Purchase Pension Plans.

Target Benefit Pension Plans aim to provide a stated retirement benefit without the guarantees. The business first determines a desired retirement benefit for each participant. An actuary then approximates the annual contribution necessary to fund this benefit based on retirement timing and return assumptions. The business agrees to contribute this amount each year for the duration of the employee’s tenure.

The key advantage here is that future benefits are a target rather than a promise. The employer contribution remains constant and no further actuarial analysis is required. Future investment results determine whether the employee receives more or less than the stated target – a design that effectively shifts all investment risk to the employee. This arrangement comes with one drawback: annual contributions are capped at $76,500 for participants over age 50 in 2024.

Money Purchase Pension Plans are simpler. No actuaries are required. Instead, the employer contributes a flat percentage of each participant’s salary annually. Participants then invest the funds at their discretion. The employer neither guarantees investment results nor future benefits. This framework mirrors a conventional Profit-Sharing Plan. The primary difference is that annual contributions are mandatory. Money Purchase Pension Plans also limit annual contributions to $76,500 for participants over age 50 in 2024.

An Evolving World

The world has changed considerably in recent decades. The past twenty years have seen two recessions, countless geopolitical conflicts, and a novel pandemic. These events reframed risk assessments and investment approaches for individuals everywhere. They also influenced retirement plan selection.

Companies increasingly seek flexible retirement plans for changing circumstances. Absent a crystal ball, companies are understandably hesitant to guarantee retirement benefits for participants. But traditional pension designs have their place under select circumstances. Guaranteed pension plans accommodate significant pretax contributions for profitable businesses. Aging owners can thereby maximize retirement assets and secure a reliable income stream well into their golden years. The key benchmark is whether the tax savings outweigh the plan costs.

Bryce Schuler, CFP®

Financial Advisor

Baldwin & Clarke Advisory Services, LLC

[1] 401(k) contribution limits reflect the 2024 annual additions limit ($69,000) and the catch-up limit for participants over age 50 ($7,500).

[2] Employers may promise up to $275,000 in yearly benefits in 2024. Funding requirements reflect benefit guarantees and actuarial assumptions.

#retirement #retirementplans #pension