Risk is an incredibly broad term, particularly in the investment world. Risk encompasses a range of factors, situations, and possibilities impacting one’s portfolio. Risk is also inherently relative. The field of behavioral finance tells us that everybody’s concept of risk is different. Individual experiences inform each person’s perception and tolerance toward risk.

Markets invoke anxiety. This encourages some to escape rather than assess. Others are drawn toward uncertainty and assume undue risk. While our fight or flight response served us throughout evolution, it often leads to poor investment outcomes. Studies show that emotion-driven investors typically underperform.[1]

Risk biases drive harmful decisions. Our brains are hardwired to draw conclusions quickly. These mental shortcuts may rely upon incomplete information. Consider the nervous investor who sells their shares at market bottom. This trade might provide momentary emotional relief. However, that individual effectively locked in losses and forfeited any opportunity for recovery. The converse is also true. An investor may cling to a single high-performing stock. They remain steadfast until an unforeseen event wipes out their portfolio. Then there is the cash-flush individual who shuns markets entirely. While that individual avoids on-paper losses, inflation slowly erodes the portfolio’s spending power over time. Each situation represents an incomplete understanding of risk.

Fortunately, a structured investment plan will combat these inclinations. Risk analysis is a key step. This exercise considers one’s circumstances (risk capacity), beliefs (risk perception), and preferences (risk tolerance). The investor’s risk profile and goals then determine a suitable portfolio structure. This objective process allows individuals to separate emotional biases from actual threats.

Countless factors and influences impact portfolio performance. Some are manageable and others are not. Regardless, proper information can guide portfolio decisions and even reframe risk evaluations altogether. This article will outline several key risk categories affecting stocks and bonds.

Deconstructing Risk

General market risk is intuitive and well-understood. The stock market fluctuates and so do your equity investments. Many individuals anchor their overall risk perceptions to this concept. Investment professionals and academics refer to market risk as a systematic risk. General market movements are unavoidable and impact nearly all portfolios on a systematic scale. Famous systemic events include the Great Depression, the 2008 Recession, and the COVID-19 Pandemic.[ii]

Systemic events are caused by various political, economic, and financial factors. These specific risks are often less understood. The Great Depression is typically attributed to financial distrust and policy failure. The 2008 Recession, on the other hand, can be traced to reckless lending and insufficient oversight. Finally, the COVID-19 Pandemic was a novel health crisis that disrupted everyday life. All were systemic events. Each was caused by a different series of circumstances.

While investors cannot avoid general market risk, they can prepare for specific risks. Mitigation strategies often target unsystematic risks, or risks unique to a particular company, industry, or region. Unsystematic risks can be managed through diversification. Investors can also mitigate, or hedge, certain systematic risks. Ultimately, investment selection determines risk exposure and preparedness.

The Safety Paradox

Some risks impact certain investments more than others. Enter Inflation Risk, or the possibility that inflation will exceed investment growth. Everyday prices tend to rise over time. Most hope that their portfolio will keep pace with these price increases. Recent inflationary surges mandate particular attention to this objective. Certain low-yielding assets are especially prone to Inflation Risk, namely “conservative” havens such as cash and certain bonds.

Inflation Risk points to a unique paradox in the investment world. “Safe” investments may protect against outright losses but leave individuals prone to other risks. Take a cash-only portfolio,[iii] which saw its purchasing power fall 15.9% from January 2021 to April 2023.[iv] Fortunately, shrewd investors can reduce Inflation Risk. Stocks and real estate have been excellent hedges against inflation over time. Some investors also hold inflation-protected bonds, commodities, and alternative investments.

Recent events highlighted another powerful risk: Interest Rate Risk. Interest Rate Risk describes the possibility that interest rates will rise in the future. Rising rates impact many different investments, but none more directly than bonds. Current bond prices fall when interest rates rise. This inverse dynamic led to nearly $1.8 billion in losses for Silicon Valley Bank.[v]

The Silicon Valley Bank collapse further illustrates the safety paradox. Many investors hold bonds to complement their stock holdings. Bonds are traditionally regarded as a source of stability when stocks wobble. However, Silicon Valley Bank’s historic demise demonstrates that overreliance upon conservative investments can be perilous. This is particularly true when coupled with inadequate liquidity management.

Note that certain bond strategies can mitigate or eliminate Interest Rate Risk. For example, some investors split their bond holdings between short-term and long-term bonds (Barbell Strategy). Others simply stagger fixed income holdings across various maturities (Ladder Strategy). Both reduce downside risk and enable the investor to purchase new bonds in a rising interest rate environment. Many bond funds employ similar approaches.

Concentrated Risks

Other risks impact a particular business or industry. Markets have provided no shortage of lessons in this category. Chief among them is the importance of diversification.

In late 2022, stakeholders lost billions when FTX crumbled. The crypto exchange’s collapse ultimately revealed extreme negligence and fraud. This example illustrates Business Risk, or the danger that a particular company will fail. A related risk category is Regulatory Risk, which describes the risk that changing laws and regulations will adversely impact an industry. Regulatory crackdowns in China decimated popular e-commerce and social media platforms.

Diversified global portfolios weathered both events. Nowadays, many investors achieve equity diversification through Mutual Funds and Exchange-Traded Funds. These investment vehicles hold hundreds or thousands of different positions. Certain separately managed accounts (SMAs) provide similar benefits. Portfolio performance should never depend upon the fate of single company or sector.

Diversification proved equally critical when Russia invaded Ukraine. This horrifying event sank Russian financial markets to near collapse. Russia’s primary stock index (MOEX) plunged 33% in one day, with certain Russian companies dropping to zero. This event demonstrated Geopolitical Risk, or the potential for tension and conflict among nations. Few foresaw Russia’s monumental violation of international law. However, diversified funds endured the crisis with minimal direct exposure. In fact, many international mutual funds and ETFs eventually divested from the country entirely.

Portfolio Construction

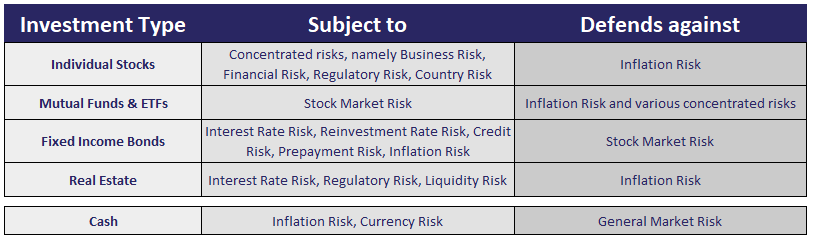

A myriad of risks impact portfolio performance. This article is by no means exhaustive. Rather, it is intended to introduce a framework for understanding risk. While general market risk impacts nearly every investment, it provides limited guidance in portfolio development. Nuanced risk analysis is far more instructive. Each investment category has a unique risk profile. This profile may clash with certain risks and combat others. The nearby table illustrates this duality.

Many risk management techniques exist. Strategies may be general or highly specific. Regardless, the approach should be individualized. Risk management must reflect one’s needs, circumstances, and objectives. Rules-of-thumb exist as guidance, not doctrine. A skilled advisor can conduct holistic analysis to form a suitable investment plan.

Likewise, a range of techniques are used to quantify, compare, and correlate risks. Financial metrics provide particular insight in this area. These measures allow professionals and ordinary investors alike to make rational portfolio decisions. Future articles will explore analytical concepts in greater depth.

Bryce Schuler, CFP®

Investment Advisor

Baldwin & Clarke Advisory Services, LLC

Email: bryceschuler@baldwinclarke.com

[1] “Investing with emotions can be costly,” Blackrock, 2023.

[ii] Systematic and systemic are related terms with key distinctions. Systematic describes risks that impact the entire market. Systemic, on the other hand, describes events that are capable of such impact.

[iii] This example assumes that the cash-only portfolio accumulates zero interest. In reality, bank accounts, certificates of deposits, and various cash-equivalents typically offer interest.

[iv] Consumer Price Index Reports, Bureau of Labor Statistics, April 2021 and January 2023.

[v] “SVB Financial Group Announces Proposed Offerings of Common Stock and Mandatory Convertible Preferred Stock,” SVB Financial Group, 8 March 2023.