January’s strong equity market performance carried over into the first few weeks of February. Since then, we have seen a strong pullback in U.S. equities. One factor is the uncertainty created by the Trump administration’s tariff policies. It is no surprise that Trump would use the threat of tariffs as a negotiating tool, we’ve seen that movie before. Some of those threats have produced the desired results, while others have been met with retaliatory tariffs, or the threat thereof. The President’s on-again/off-again tactics have had unsettling effects on the global economy and have created problems for U.S. businesses, large and small. It’s difficult to invest in growth initiatives when you have no idea what future costs will be.

While this uncertainty added to February’s pull back in U.S. stocks, it was not, in my view, the driving factor. The reality is that the market had been overbought for some time, led by the 10 largest tech companies which make up about one-third of the value of the S&P 500. A pullback at some level was inevitable. The tech stocks were trading at overly high earnings multiples driven by unrealistic earnings. That multiple expansion caused other stock prices to grow as well. When big tech earnings no longer supported their lofty P/E ratios they, and the market generally, were ready for a fall, and the multiples did just that. The first trigger was China’s DeepSeek AI software bombshell.

Nonetheless, increasing concerns about a tariff war and possible inflation led to a further pullback in the equity markets in March.

Trump’s objectives are to use tariffs to protect, and perhaps more importantly, grow U.S. manufacturing, for both job creation and national security reasons. With globalization, U.S. manufacturing has grown by only 4.3% over the last 25 years, an annualized growth rate of just .2%, which has impeded overall economic growth. Other countries impose tariffs on U.S. imports to protect their companies, or in some cases to raise revenue, knowing that certain companies will pay to reach their markets, China in particular. There is something to be said for wanting to level the playing field. Here are few interesting metrics.

- The U.S. average effective tariff rate on all imports is only 2%.

- Tariff revenue as a share of total federal receipts is also 2%.

- The USA’s simple average tariff rate on all imported goods is 3.3%.

- Mexico, the largest exporter to the U.S., has an average rate of 6.8%.

- China, the second largest, has an average rate of 7.5%.

- Canada, the third largest, has an average rate of 3.8%.

- Our ninth and tenth largest exporters, South Korea and India, have average rates of 13.4% and 17% respectively.

The extent to which tariffs may be inflationary will depend on many factors. For example, consumers changing their buying habits to avoid tariffs could be a mitigating factor. Trump’s team hopes to offset those inflationary pressures with inflation reducing efforts, e.g. lower energy costs. The President also sees tariffs as a source of increased federal revenue to offset revenue lost to his expectation of lower taxes. This could lead to more permanent and fewer temporary tariffs, adding to inflationary pressures. Who knows how it will all shake out. The President is scheduled to announce “final” targeted tariff rates on April 2nd. Some degree of certainty may quiet things down a bit. Watching the supply side and demand side economists fighting it out will be interesting sport.

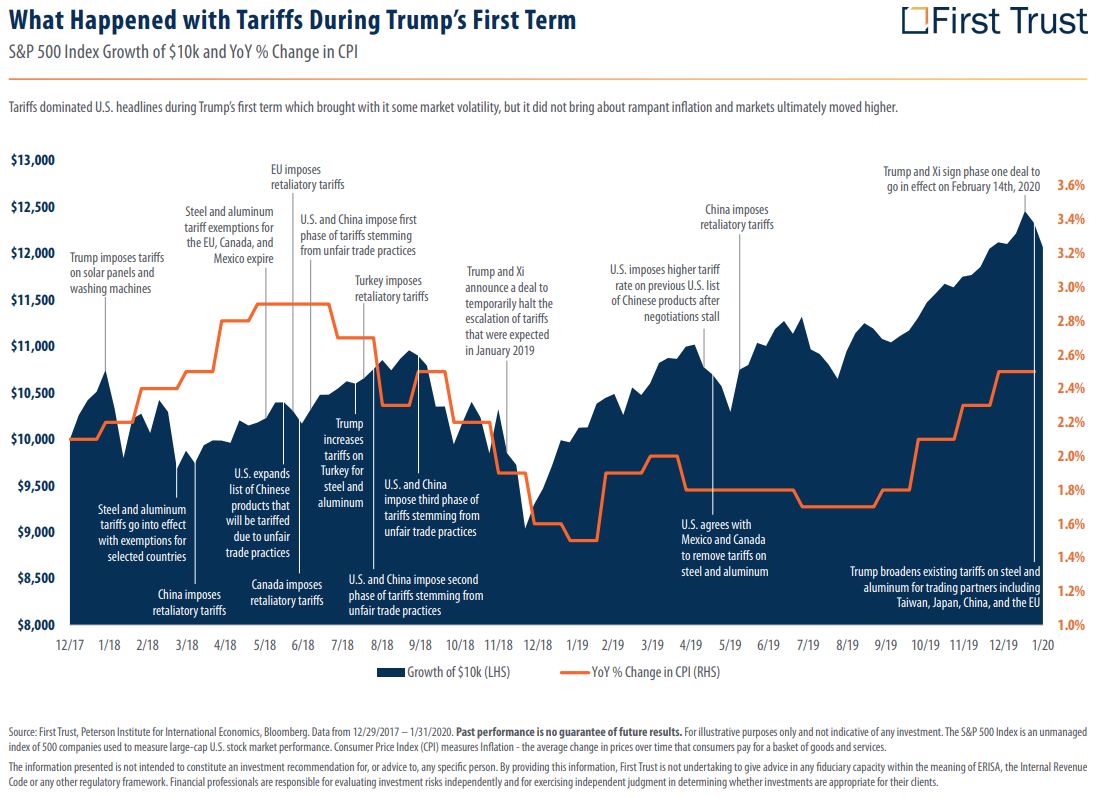

The chart at the end of this piece shows that, while Trump’s first term tariffs were not inflationary, tariff related events spiked volatility. Nonetheless, markets ultimately moved higher.

A slowing economy, weakening consumer confidence, some cracks showing in the labor market, the Fed’s continuing higher-for-longer posture and tariff wars are rekindling talk of a recession, perhaps as early as Q4, but more likely, if at all, next year. Talk is the operative word. We’re not seeing any definitive predictions of a recession. Trump’s first term gave us the Tax Cut and Jobs Act’s tax reductions. They are due to expire on 12/31/2025. If they are not extended by Congress, the economic impact on businesses and individual taxpayers would likely increase the possibility of a recession. It would be the largest tax increase ever.

Tariff uncertainty is but one of many factors impacting the U.S. equity markets. GDP growth is slowing. As of today, the Atlanta Fed’s GDPNow model pegs the real GDP growth rate for Q1 at -2.8%. A very cold January led to low consumer spending. Imports are another factor impacting GDP expectations. The government arrives at the GDP number by adding up all the things we buy—whether by consumers, governments or businesses—and then subtracting out imports. January’s advance report on international trade reported a huge surge in imports for the month, led by industrial supplies. Many importers were presumably trying to get ahead of Trump’s tariff increases.

We also can’t ignore the impact of the massive, programmed trading triggered by algorithms that respond to technical market metrics. It has also fueled the sell off.

There have been a few bright spots for diversified portfolios during this downturn. First, as interest rates have fallen, bond prices have moved up. It’s refreshing to see bond prices not moving in sync with stock prices, which hasn’t been the case in recent years. Secondly, international stocks have done well.

There had been a modest rally since the sharpest drop in the U.S. markets. It leaked into the week ending 3/21/2025 which gave us positive numbers for U.S. and international stocks and bonds, only to see the gains eroded in a sharp last week. The Fed’s favorite inflation measure, PCE (Personal Consumer Expenditures) came in last Thursday with increases of 2.5% year over year, 2.40% quarter over quarter and .30% month over month. Two monthly increases in a row. The likelihood of near-term Fed economy boosting rate cut is becoming more and more remote.

To end on an optimistic note: “Earnings season” ended a few weeks ago with corporate earnings growth up 12% coupled with profit margin growth of 13%. That’s the best combination since 2021. When “noise” gets out of the way, it’s earnings that drive stock prices. A new earnings season will be starting soon. Let’s hope for a good one.

#EconomicOutlook #EquityMarkets #InvestmentStrategy #MarketVolatility #TariffPolicies