The Next 10 years: Muted Return Expectations

According to a recent article in the Financial Times, the traditional 60% stock, 40% bond portfolio appears to be obsolete due to the probable underperformance of both of its components for years to come. The forward-looking capital market assumptions from many of the world’s leading asset managers and investment consultants imply tepid returns for stocks and bonds for the coming 10 years.

One such firm, Callan Associates, develops 10-year return and risk expectations for 22 asset classes each year. Using its 2021 assumptions for a 60% U.S. large cap stock, and 40% U.S. core fixed income portfolio, Callan’s 10 year geometric (think compounded) mean return expectation is 4.6%. (Expected annualized returns are 6.5% for U.S. large caps and 1.74% for core bonds.) The inflation assumption is 2%.

Callan is not alone. Goldman Sachs’ estimated annualized 10-year return for a 60/40 portfolio is 4.7%. (Based on Goldman’s assumptions as of 6/30/2021.) BlackRock’s estimated 60/40 portfolio annualized return is even lower at 3.51% owing to its fixed income return expectation of only .08%. These examples are representative of the reports we’ve seen across the board.

Because of the well-above average returns of this long running bull market, it’s easy to assume that these estimates may be based on the prevailing view that there will be a “reversion to the mean”. While reversions are observable, and perhaps inevitable, there is no viably predictive math behind them; no causality. These firms examine several economic and market factors along with lessons learned from history, to formulate their expectations. They, like BaldwinClarke, use them to create efficient client portfolios that optimize expected returns relative to various risk tolerance levels.

The extraordinarily low fixed income return estimates are the primary driver of these muted returns. Return correlations between asset classes also play a key role in determining expected portfolio returns. Bonds have lost some of their value as diversifiers as their returns are increasingly corelated with equity returns.

Keep in mind that these are nominal estimated returns. Planning for real, or after inflation returns, will add more complexity and risk than discussed below.

What Does This Mean to Me?

“Okay, so my returns are likely to be much lower in the coming 10 years. What do I do about it?”

First, depending on your individual circumstances, the answer may be to simply accept the lower returns, either because you have no need for higher returns or wish to avoid the risk associated with higher returns. If the success of your financial or retirement plans is dependent on returns greater than current expectations, it’s time to consider a review with your financial advisor.

Second, recognize that meeting the challenges of muted return expectations will add to portfolio complexity, require a new way to look at portfolio construction, and heightened risk awareness and management.

Complexity

An investor who had a portfolio made up of a 60% allocation to an S&P 500 index fund and 40% to a Bloomberg Barclays US Aggregate Bond index fund, would have enjoyed compounded annual returns of 7.10% over the 10 years, ended 9/30/21.

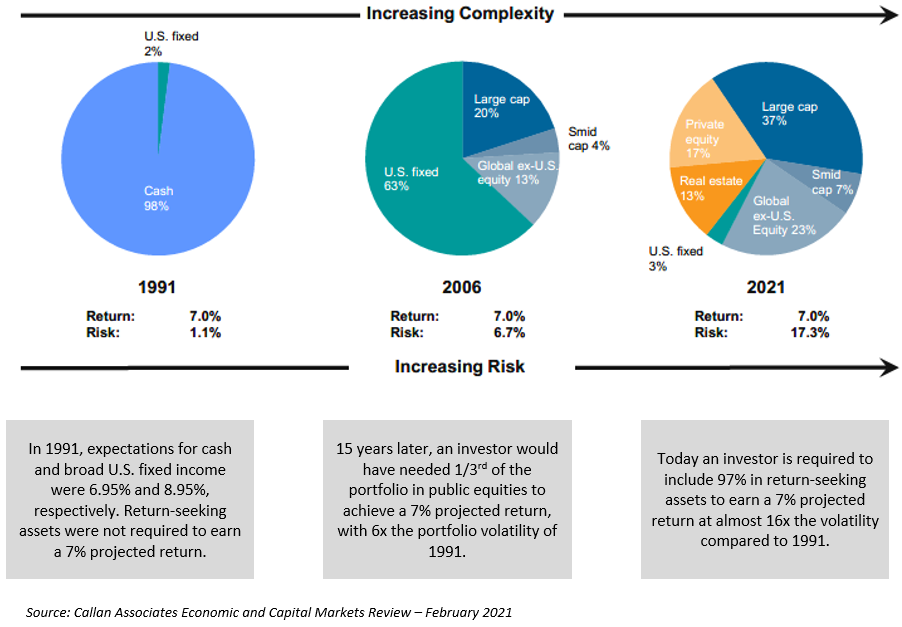

Let’s take a deeper look into what was, and is now, required as an asset allocation to achieve a 7% return and the risks associated with those portfolios (standard deviation is used to measure risk).

7% Expected Returns Over Past 30+ Years

If we were solving for a real return of 5% in each of the above years, there would have been much more complex allocations in 1991 and 2006 than those shown above, largely because inflation estimates in 1991 and 2006 were 5% and 2.75% respectively. The standard deviations would have gone up to 6.6% and 9.3% respectively. The 2021 allocation and risk would remain unchanged, but the return would drop from 7% to 5%.

A New Way to Look at Portfolio Construction.

Looking at portfolio construction through the lens of Stock, Bonds and Cash simply isn’t enough, even if they are diversified into sub-categories. It’s more helpful to look at portfolio construction through a prism of Core, Satellite, Alternative and Tactical allocations.

Core assets are a combination of equity and fixed income positions intended to provide market participation with allocations to managers with histories of strong upside/downside capture ratios.

Satellites are specialty equity and fixed income holdings designed to enhance returns and/or modify risk.

Alternatives, or Alts, include various hedging strategies, private credit, real estate and equity. These serve as return enhancers and risk modifiers, often with returns not highly correlated with Core assets.

Tactical allocations are made to managers who adjust their allocations to a variety of core and/or satellite holdings in response to market, economic or investor sentiment conditions. They add the element of responsiveness to a long-term strategic allocation.

Risk Awareness and Management

As noted above, a 60/40 portfolio provided a 7.10% return over the last 10 year. The 2021 allocation to achieve a 7% return in the next 10 years requires a 97% allocation to risk assets as shown in the above pie chart. Managing risk in this new environment requires looking at every tool in the box. Callan, for example, has 22 asset classes available for inclusion in portfolio allocations. A broader than usual mix of asset classes should be considered. The correlation of returns between asset classes must be carefully examined to achieve meaningful risk reducing diversification. Manager selection will play an even greater role than before to provide downside protection.

The muted return future is no secret to major banks and investment firms who are designing a wide array of structured products intended to improve returns in the fixed income/credit space. These are complex offerings and their risks need to be understood before investing.

Investment companies, large and small alike, are bringing these new products and investment strategies to market at a pace we have not seen before. Most strategies are technology driven and their creators are certain that their AI-driven algorithms may reduce downside risk and consequently enhance long term returns. All have rigorous back tested results to prove their points.

Whose black box is the best? Difficult to say. Many of these firms are backed by Private equity and have poured millions of dollars into R&D. Some will be winners, others not. The point is, the investment world is changing rapidly and much of the change is being driven by muted returns expectations, and the higher risks that must be assumed to sustain reasonable real returns. Hop on board, but seek professional guidance.

A final note on risk management; we caution against index funds in the late stages of a bull market. It’s not news that Indexes capture 100% of the downside, and we all know there will be a reversion to the mean, don’t we?

Chuck Baldwin

Co-Founder & Principal

BaldwinClarke