If you happen to follow the merger and acquisition (M&A) marketplace, you are well aware that activity has been relatively subdued. After a couple of record activity years emerging from the pandemic, dealmakers and market participants witnessed a more conservative transactional attitude by both buyers and sellers in 2022 and 2023 – in large part due to the well-covered macro influences of 1) interest rates, 2) inflation, and 3) economic and geopolitical concerns. When you mix rising costs with uncertainty, the acquisitive world typically pulls back to reassess and reposition.

In the face of the muted environment there have been calls by analysts, researchers and industry participants alike that the deal environment will show signs of greater life in 2024 as the above-referenced headwinds have evidenced either progress or resilience. Inflation is coming in-line with the Fed target (2.4% annual increase in the CPI for September), an interest rate cutting campaign has just begun (50 bps cut by the Fed in September), and the economy is holding in there (GDP growth of 3.0% in the 2nd quarter per the 3rd estimate). While the macro climate appears to be lining up to support the more vibrant deal thesis, the proof has yet to fully materialize in terms of robust transaction activity. It appears the engine needs more time to warm up.

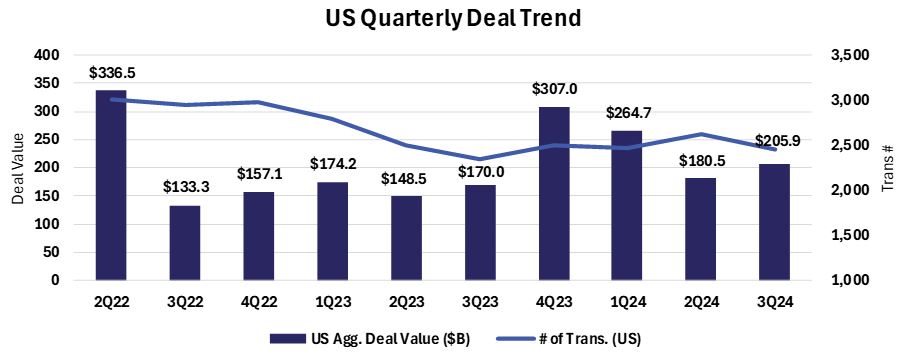

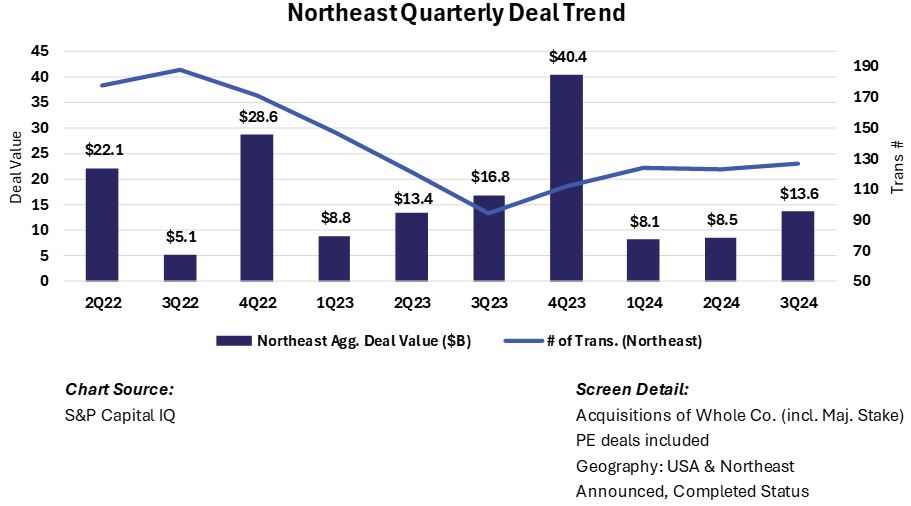

The following is a graphical recap of domestic transaction activity across the US and Northeast over the last two and a half years. As you can see, there is no ‘upward and to the right’ trend of significance as of yet, but perhaps there are some signs of thaw and improvement.

Now after broadly taking stock of deal activity levels, let’s cover some observations and prevalent themes underpinning the market (in no particular order of importance and not meant to be an all-encompassing summary):

Fewer high-quality targets / A+ assets: Why sell into a less than optimal climate if you don’t have to, right? That’s effectively the dynamic with this observation as buyers are having to turn over more rocks, as well as compete with other well-healed investors for premium companies. Natural headwinds have caused some would-be sellers to continue to operate and generate organic returns while they monitor market conditions. After all, syncing market timing with personal timing and business performance, if you can do it, typically yields favorable results.

Increased due diligence by buyers: The element and assessment of risk is a big factor in business valuations and a key component to getting deals done. To manage risk, we are seeing and hearing of increased levels of due diligence on the part of buyers. More intensive diligence elongates closing timetables and leads to abandoned processes. Companies well prepared for a sale process and resulting investigation of their operations, financial performance, corporate governance, etc. will fare better in terms of their success reaching the finish line and preserving value along the way.

Private Equity: Easier add-ons, less platforms, take private gaining steam: The observation here is that buyers, given the uncertainty of the marketplace, are taking smaller, more conservative bites as they focus more inwardly on optimizing their current portfolio of assets. PE firms are deploying their ample capital by taking more bites, just smaller ones. Per ACG’s Middle Market DealMaker publication, deal volume for the larger end of the market is down 55% compared to the peak in 2021 and down 25% from 2023. Further, PE appears to be looking more concertedly at take-private opportunities given the concentration in the public markets (e.g. Magnificent 7) and the opportunity to take advantage of good companies that have been somewhat left behind.

Valuation Gaps: The bid/ask spread between what a seller wants to receive and what a buyer wants to pay is always a top issue in getting deals down. When coupled with higher financing costs, out of favor industry targets are particularly prone to larger valuation gaps. Further contributing to pricing disconnects are situations where founders/owners are rooting their expectations based on perhaps stale or historical multiples (i.e. completed deals in times when it was a “seller’s market”). That said, according to 2Q24 EY survey of private equity general partners, 77% of the polled participants believed the valuation gap has been narrowing in 2024.

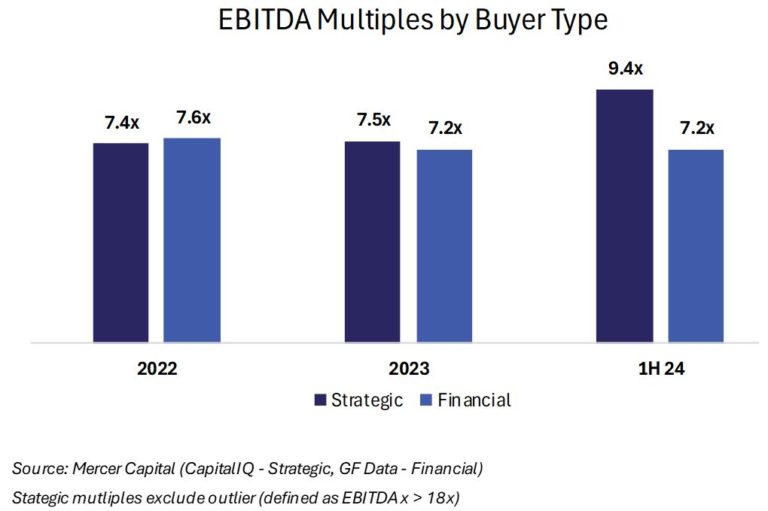

Price Stability (Resilience): Notwithstanding the general issue of valuation expectations, pricing of deals has been relatively resilient. The following table from Mercer Capital’s Middle Market Transaction Update (Fall 2024) report shows EBITDA multiples hanging in there based on transactions data both strategic and financials buyers (caution when observing and relating the following graph as the data covers enterprise values ranging from $10 million to $500 million and is likely further influenced by including industries that garner larger multiples due to growth profiles or industry dynamics – e.g. info. tech companies):

Looking out more broadly, another look at private company valuations can be derived by the Lincoln Private Market Index (“LPMI”), an index maintained by Lincoln International that tracks changes in the enterprise value of U.S. privately held companies. Per the most recent LPMI reading, the index increased by 1.9% during the second quarter of 2024 (a new high). For both the Lincoln PMI and S&P 500, growth was largely driven by improved performance offset by some multiple contraction.

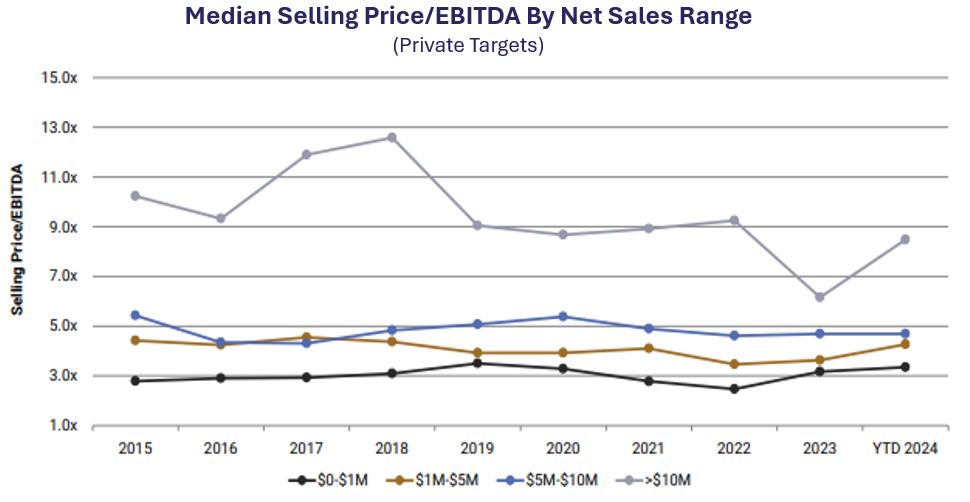

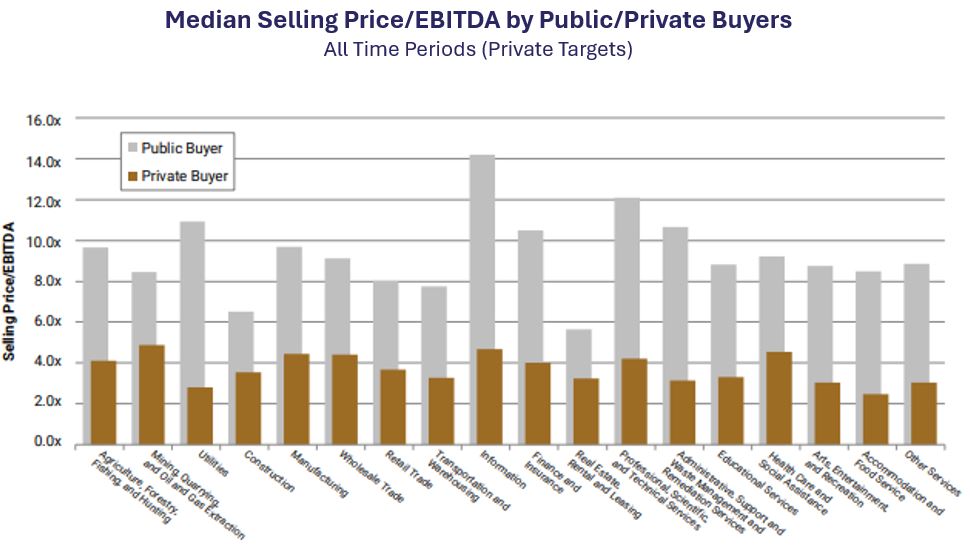

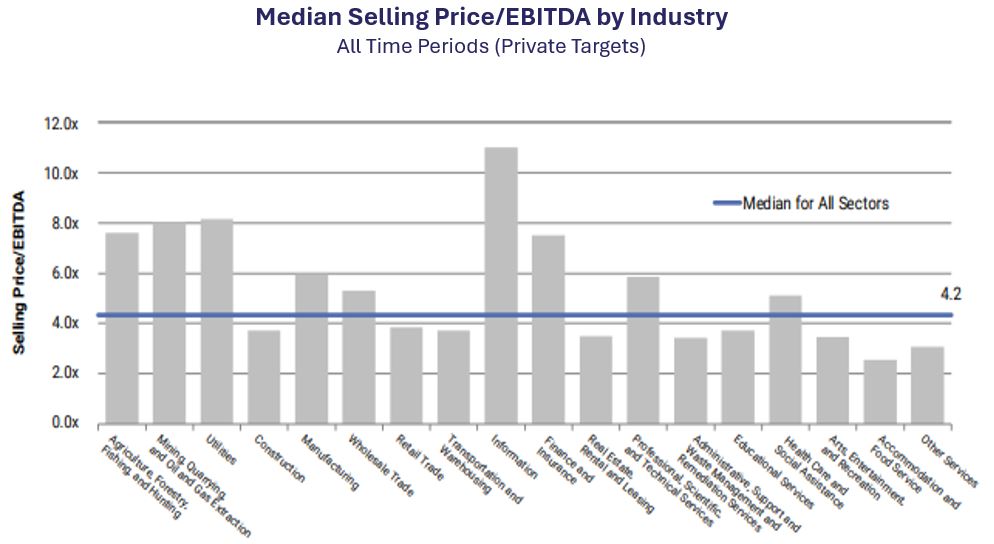

Price Context: This is more of an add-on comment versus current observation, but it makes sense to quickly touch further on our parenthetical point above regarding how pricing indicators can be either instructive or misleading based on qualities such as company size, buyer type and industry. In short, it is typically the case that larger companies garner higher valuations. Same can be said when the buyers are public as opposed to private. Industries also have their own unique set of dynamics that command, in some instances, very different multiples. We often advise people to resist putting too much reliance on water cooler valuation talk for the reasons stated above as well as encourage taking the time to fully understand their business’s unique value characteristics — as pricing (valuation) rules of thumb are not always applicable. The following visuals from Business Valuation Resources DealStats Value Index, which summarizes valuation multiples for acquired private companies, provides this context.

Sector Du Jour: Sectors and industries come in and out of favor depending on a number of factors and market forces. This has always been the case as economic tides ebb and flow. What is making sectors attractive at present? From what we’ve gleaned, the general profile includes areas that are not hugely asset intensive, have strong margin profiles and exhibit positive growth trends. Again, per ACG’s Middle Market DealMaker Fall 2024 report, attractive sectors include consumer services, industrial services, IT services, facility services, marketing services and maintenance repair and overhaul. Through another lens, per the AM&AA 2024-Q3 M&A Market Survey Report (a poll of 244 respondents), note industries seeing the most closed deals in the first half of 2024 as well as being most under LOI in 3Q24 were 1) construction & construction materials, and 2) manufacturing. We’d be remiss not to mention the capital flowing into AI technology and the changing PE involvement in professional sports as well.

Where from here? It’s hard to truly know, but the overall sentiment seems to suggest a solid, yet unspectacular market for deal making going forward. Interest rates are coming down, bank lending appears to be more available, the economy is holding steady, and general business operations are more “normalized” thanks to improving inflation and supply chains. Another leading indicator is confidence, particularly that of CEOs and business leaders. The more comfortable and confident the C-suite is, the more apt organizations are to deploy capital and to more aggressively pursue growth. A couple of resources measuring this sentiment include The Conference Board’s Measure of CEO ConfidenceTM gauge, which currently sits at 52 (a measure of above 50 reflecting moderate optimism) and the Vistage CEO Confidence Index – last standing at 83.3 (up from 73.4 eight quarters ago, albeit down q/q from 85.9). Taken together, the blended overall tone appears solid, yet conservative — similar to how we would describe the current feel and direction of the deal market.