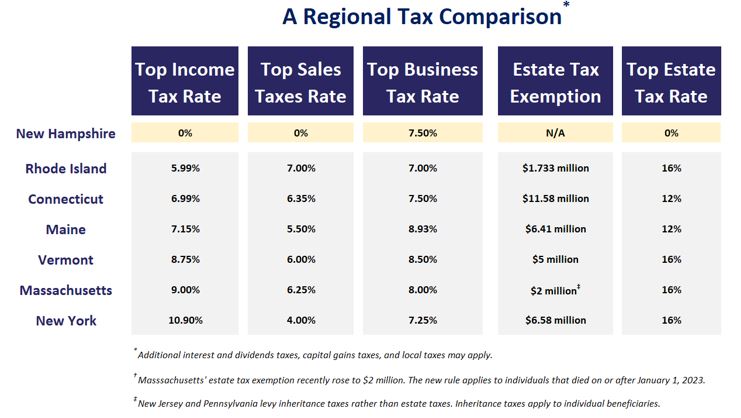

New Hampshire is no stranger to contradictions in nature, politics, or life. Mountainous frontiers to the north juxtapose oceanfront communities to the east. A state committed to individualism also values civic engagement. Multi-generational residents coexist with droves of new arrivals. The list goes on, but one contradiction deserves closer inspection. New Hampshire is a tax-friendly enclave in a high-tax region.

New Hampshire’s tax-friendly reputation is no secret. For decades, legislators have lured out-of-state taxpayers and businesses with savings opportunities. The results are obvious throughout New Hampshire’s sprawling suburbs and exurbs. Home prices are near all-time highs, commuter traffic grows each year, and commercial development continues to expand.[1] Migration trends appear to be accelerating thanks to the Massachusetts Millionaire’s Tax.[2]

Most understand that New Hampshire has no state income tax. However, several other perks are available to ordinary households, local businesses, and certain trusts. The following sections summarize the state’s key tax advantages. Readers should note that some techniques involve complex laws and strategies. A New Hampshire-based advisor can evaluate suitability and provide personalized guidance.

No Income Taxes

New Hampshire is one of nine states with no income tax. This is the state’s primary value proposition to prospective residents. New arrivals may see an immediate boost in their take-home pay – but only if they meet certain requirements.

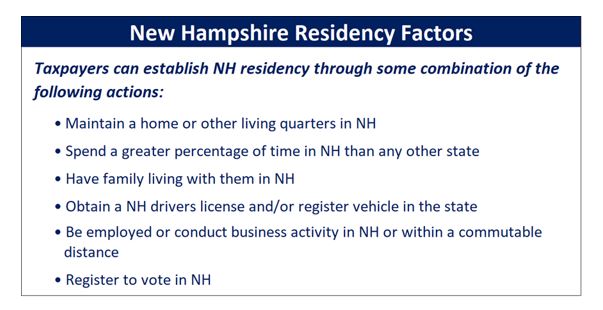

The first requirement involves residency. Some states define a resident as anybody who maintains a permanent abode and spends a certain number of days there. The annual threshold might be 183 days (MA, ME, RI) or 184 days (NY). Other states apply a simpler framework, defining a resident as anybody domiciled there for the entire tax year (CT).

New Hampshire’s residency rules are unique. The Department of Revenue defines a resident as anybody with an ongoing, non-transient presence in the state. This vague standard is generally satisfied by maintaining a home in New Hampshire and spending a greater amount of time there than any other state. Additional factors are listed below.

Multi-state real estate portfolios may involve conflicting residency rules. For example, an individual with homes in Massachusetts, New York, and New Hampshire is subject to each state’s requirements. This situation requires careful residency planning to enjoy New Hampshire’s tax rules and avoid triggering residency elsewhere. Taxpayers often supply corroborating documentation to this end.[3]

The income source also matters. Income is generally taxed where it is earned. This means that out-of-state and remote employees owe income taxes to their employer’s state. New Hampshire officials have pushed back against this rule with little success.[4]

Similar caveats exist for business owners. Businesses may enjoy New Hampshire income tax benefits if the entity is headquartered there, but income earned elsewhere might be subject to out-of-state taxes. Furthermore, company relocations may trigger undesirable tax consequences. An advisor or tax professional can review company financials, assess apportionment requirements, and determine tax implications.

Interest and Dividends Tax Phaseout

Assets fall under many different categories. There are income-producing assets, growth-oriented assets, use-assets, and others. Each category serves a unique purpose, but all are subject to taxation.

Income-producing assets are particularly tax prone. These include bonds, dividend stocks, and certain business interests. All serve important income streams. There are retirees that fund spending needs entirely from bond interest and stock dividends. There are also trusts that distribute all investment income annually. Then there are businesses that generate investment income or pay periodic dividends to owners.

These payments typically trigger federal and state taxes. Federal taxes are often unavoidable and apply to every U.S. citizen. State taxes ultimately depend upon residency status. New Hampshire residents and businesses stand to benefit from a recent reform.

New Hampshire’s budget eliminates the state interest and dividends tax after 2024. This will result in lower taxes, larger income streams, and greater spending power for Granite Staters. The law’s phaseout period reduces the New Hampshire interest and dividends tax from 4% in 2023, to 3% in 2024, to 0% in 2025 and beyond. Business owners should note that the Business Profits Tax (BPT) still applies to net business profits. Likewise, the Business Enterprise Tax (BET) may apply to the enterprise value tax base.

No Capital Gains Taxes

Other assets are only taxed at sale. These include speculative investments, personal homes, and certain business assets.[5] Investors may receive little or no income during the ownership period. Instead, returns are realized years later if the asset is sold at a gain.

Federal and state capital gains taxes erode these gains. Several factors impact the tax calculation, including the cost basis, asset type, and ownership period. Another important factor is the taxpayer’s state of residency. Unsurprisingly, certain states are more accommodating than others.

New Hampshire is one of nine states with no capital gains tax. This is an important perk, and perhaps a welcome catalyst, for those carrying significant gains. New Hampshire residents realize larger after-tax profits when they sell appreciated stock positions, business assets, and real estate holdings.

No Estate Taxes

Assets are taxed during life and at death. While federal estate taxes target America’s ultra-wealthy, many states impose a separate state estate tax. Certain states demand significant taxes from otherwise modest estates.

New Hampshire has no state estate tax. This is a notable advantage over other states in the region, particularly New Hampshire’s southern neighbor. In 2023, Massachusetts residents owe state death taxes if their estates exceed $2 million. Many are shocked to discover their projected estates meet this threshold.

Estate taxes are not limited to the country’s elite. Ordinary situations can inflate estate values and trigger state death taxes: a childhood home, a successful family business, or a well-invested nest egg. Free of estate taxes, eligible New Hampshire residents may pass larger legacies to future generations. The state’s unique trust laws bolster this comparative advantage.

Estate planning involves countless rules and strategies. Certain steps may be necessary to utilize New Hampshire’s estate tax laws and/or mitigate estate taxes elsewhere. Individuals should always consult an experienced planner or attorney for advice.

No Sales Taxes

New Hampshire is also one of five states with no sales tax. This feature is unique because it is available to both residents and non-residents. Again, certain caveats apply.

Items purchased or delivered in-state typically enjoy no sales tax.[6] This might include a coffee purchased at the local café, a TV shipped to one’s home, or an excavator delivered to a job site. Savings can be substantial, particularly for high-priced items.

Anybody maintaining an address or conducting business in New Hampshire can benefit. This includes part-time residents and out-of-state business owners. Using the previous example, someone with multiple homes may ship an expensive item, such as a laptop, to his or her New Hampshire residence. This individual pays no sales tax on the purchase, regardless of residency status.

The same logic applies to out-of-state business owners. Consider a contractor who operates across the Northeast. The contractor might ship large machinery to a New Hampshire office or job site. These items avoid sales tax at purchase. Assets can then be transported elsewhere after delivery. As always, it is wise to consult a financial advisor or tax professional before proceeding.

Autonomy & Discretion

New Hampshire has long been an outlier. This is a descriptor that residents accept and embrace. Look no further than New Hampshire’s state motto – Live Free or Die – a now ubiquitous rallying cry displayed on t-shirts, license plates, and highway signs. The state’s tax benefits reflect this independent spirit and drive continued growth.

Economic boom brings modern challenges. The nation’s second-oldest state faces housing shortages, infrastructure problems, and wildlife concerns. Growing pains will persist as employers confront an aging workforce and a widening labor gap.[7] Solutions should address these issues while preserving the state’s unique identity.

New Hampshire’s value proposition depends upon the individual. Some perks are designed for wealthier taxpayers, and others are only available under limited circumstances. Individuals should also weigh other factors such as property and consumption taxes. Ultimately, a comprehensive tax analysis is necessary to determine the benefits for each person.

[1] Briand, Paul. “NH home prices ease from June record, but still second highest ever,” NH Business Review, 9 August 2023.

[2] Briand, Paul. “Is New Hampshire starting to cash in on the Massachusetts ‘Millionaire’s Tax’?,” NH Business Review, 9 February 2023.

[3] Documentation is particularly important for new residents. Evidence should clearly demonstrate that the taxpayer terminated domicile in the previous state and established domicile in New Hampshire.

[4] Wade, Christian M. “New Hampshire moves to shield remote workers from out-of-state taxation,” NH Business Review, 17 March 2022.

[5] Note that real estate assets held outside of New Hampshire may be subject to out-of-state capital gains taxes.

[6] Sourcing rules determine which sales tax jurisdiction applies. New Hampshire’s destination-based approach is relatively simple. Any products or services received in New Hampshire enjoy no sales tax. Items shipped to a New Hampshire address typically qualify. Exceptions may exist for services received out-of-state, such as concerts and sporting events.

[7] Mowry, Matthew J. “NH Facing 190,000+ Job Gap in Next Decade,” Business NH Magazine, 29 August 2023.

#NewHampshire #NHtax #tax #taxplanning